2022.11.15

Electronics tax – new calculated tax rates

In previous years, the new tax rates and ceiling limits for the LSKE tax (electronics tax on white goods and home electronics) for the following year have been presented very close to the turn of the year by the Swedish Tax Agency. The background is the annual increase with the CPI, which the Riksdag had previously decided on.

The decision taken by the Riksdag on 26 October concerned the proposal for an additional 2 percent increase on top of the CPI increase to match GDP growth – this proposal from the previous government was rejected by the Riksdag. However, with today's inflation trend, it is no surprise that the CPI increase will still "bite the dust" and ultimately fuel inflation.

Now, anyone who has looked closely at the Budget Bill for 2023, which was presented on November 8, has been able to see that the Ministry of Finance has already presented the tax rates that will apply after the CPI adjustment from January 1, 2023.

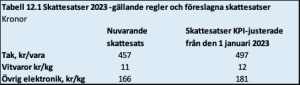

The new, calculated tax rates and the new maximum tax ceiling per product are shown in the table above and are valid from January 1, 2023 for producers, importers, approved warehouse keepers and other taxpayers who operate in Sweden or import here.

Tax increase: just over 8 percent

This means that the industry's taxable white goods look set to receive a tax increase of just over 8 percent for the coming year. This means that, for example, an ordinary washing machine will carry an inherent (electronics) tax of over SEK 620 since VAT is also added to the tax amount for the washing machine in the example.

For now, we should probably all consider the new tax rates as preliminary until they are fully confirmed by the Swedish Tax Agency, which should normally happen at the turn of November/December. However, it may still be appropriate to prepare the extensive work within companies to change tax rates and weight restrictions for their entire product range using this information as a basis.

Next change already in July 2023

Please note that the next change in tax rates will likely take place as early as 1 July 2023. This is due to major changes proposed in the Budget Bill regarding the deduction system within the electronics tax. No consideration will then be taken into account whether the flame retardants are additively or reactively added, which will have major consequences for the possible tax deductions that have so far been possible for electronics with reactively added flame retardants. This will be ”compensated” with adjusted tax rates at the end of the year.

The budget bill de facto also contains information on these new tax rates from July 2023, but APPLiAnytt chooses not to present them here because there is some conflicting information about which levels apply in the government's budget documents. We have contacted the Ministry of Finance and the Swedish Tax Agency for clarification and expect to return with information on this as soon as possible.

Text: Kent Oderud