2023.10.25

The evidence is accumulating – the government deceived the Riksdag

On July 1st of this year, the deduction option was removed for the part of the electronics tax that concerned reactively added flame retardants. Reactively added flame retardants are considered the better environmental alternative for adding to electronics to protect against fire. The additively added agents, on the other hand, had no possibility of deduction.

The change, which was presented by the Ministry of Finance as a simplification, would does not mean that tax collection increased, according to the Minister of Finance in the bill. From the start, the proposal was heavily criticized by the industry. The officials at the Government Offices and the Ministry of Finance who investigated the issue ahead of the autumn budget were completely incomprehensible to our criticism. The politicians in the Tax Committee considered themselves tied down by the Ministry of Finance. The Riksdag's investigative service did not undertake to investigate the matter as they did not consider themselves competent and did not want to bring in expertise from either industry organizations or companies in the industry.

Now it turns out, when APPLiA has obtained the latest information from the Swedish Tax Agency, that the Riksdag was seriously deceived. The Tax Committee was deceived. Consumers are being deceived.

Tax collection has increased by almost 50 percent

What was not supposed to increase at all according to the government has now resulted in an increase in the tax collection for the electronics tax by almost 50 percent when it comes to white goods. The figures from the declared electronics tax in July and August now show that the tax collection for white goods has increased to 40.6 percent (equivalent to 129 million for these two months) while the market has fallen by 7.7 percent during the same time (seen as reduced gross tax in the Swedish Tax Agency's figures). Together, this means that the actual tax collection has increased by just over 48 percent during these two months, when the new rules have been in force. And on top of that, other home electronics such as TVs, computers, mobile phones, etc.

Consumers have to pay

Since in principle no tax deductions can be made for washing machines, dryers, etc., there is a great risk that consumers who are now looking for new, energy-efficient appliances will have to dig deeper into their wallets or forgo energy efficiency improvements for cost reasons.

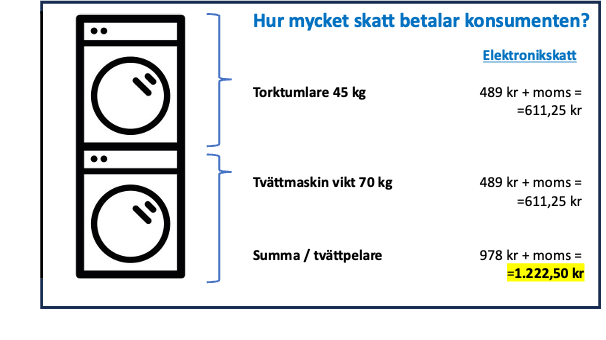

In the example above, it is clear that a laundry column containing a washing machine and dryer is charged with over SEK 1,200 on top of the price because the electronics tax is also subject to VAT. This makes the product significantly more expensive without achieving any environmental effect.

The Swedish electronics tax affects inflation more than it affects the environment. It is time for our politicians to finally fulfill their promises to abolish the Swedish electronics tax and instead work for stronger regulation of flame retardants within the EU. It is not enough to fool both the Riksdag, the Riksdag Tax Committee or Sweden's consumers anymore!

By clicking here You will have access to APPLiA's entire compilation and calculation of the Swedish Tax Agency's raw data.