2025.09.15

White goods are taxed extra in Sweden

What are modern white goods made of? This is a question that is asked – not least for recycling reasons and as pure consumer information, but also by the Swedish Tax Agency.

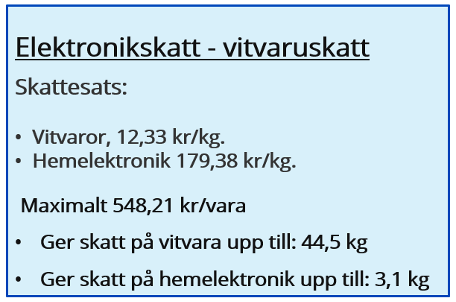

Since 2017, white goods have been taxed extra in Sweden with the so-called electronics tax of over 12 SEK per kilogram measured on the weight of the entire product.

The dishwasher weighing around 45 kg thus costs 685 SEK more for the consumer in Sweden than in our neighboring countries due to this Swedish tax (which is also subject to VAT). Since the introduction of the electronics tax, Swedish consumers have been taxed with up to 15 billion SEK – without the tax's original objective being met.

Source: Swedish Tax Agency

The tax is justified by the fact that white goods contain one or more electronic boards, which must be flame-retardant according to regulations in order not to cause fires in households worldwide. These flame retardants are not prohibited under EU regulations, but are nevertheless taxed in Sweden in the belief that this could lead to a substitution of specific chemical agents with flame-retardant properties.

What materials do we find in modern appliances?

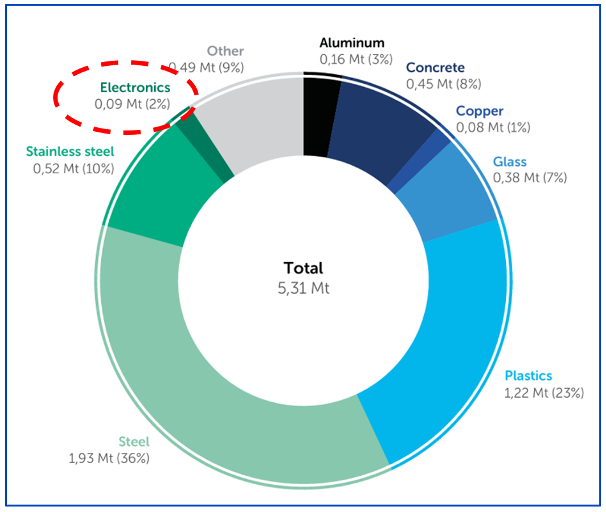

The amount of individual materials in modern white goods can vary considerably depending on the type of white good – for example, a washing machine, refrigerator, stove or oven – and its specific design. On average, across all types of white goods, steel is the most dominant component, followed by plastic, stainless steel and glass.

The proportion of electronics is vanishingly small

The electronic content (”electronics” in the diagram) only makes up a tiny fraction of the material content in modern white goods. Barely 2 percent! Yet, white goods are ”taxed” on electronics based on their total weight at 12.33 SEK per kilo by the Swedish tax system. This results in a substantial increase in the cost of purchasing energy-efficient white goods for the home, but also on all other home electronics such as mobile phones, TVs, computer monitors, game consoles and PCs, which are purchased in large quantities by schools and private individuals. All the while foreign e-commerce – a click away for us Swedes – rubs its hands and evades the tax.

Tax by weight – no problem!

The electronics tax is being heavily criticized by, among others, authorities, experts/professors, the trade and many industry representatives. The fact that the tax is levied on the entire weight of the product – including all parts, which are actually desirable resources such as recycled materials, e.g. the steel in the refrigerator, the copper in electric motors, the plastic in the vacuum cleaner – does not really make sense at all.

Time to do a workshop, best politician!

APPLiA is trying hard to get our Swedish politicians to back down from all their statements about how bad this tax is for Sweden's competitiveness in trade, for consumers' finances and for the heavy tax administration for companies, which leads to substantial increases in costs!

It's time to take action now by immediately abolishing this ineffective tax, which has had no demonstrable positive impact on the environment!