2024.02.02

The increase in the electronics tax for white goods is boosting inflation

The increased tax collection from the electronics tax is reflected in Statistics Sweden's latest inflation statistics for both private consumption and construction costs. Overall, the figures show that this Swedish special taxation on white goods and home electronics is pushing up inflation.

Inflation continued to decline in December 2023, from 5.8 percent in November to 4.4 percent in December, Statistics Sweden announced in January. The main reason for the decrease was the significantly lower electricity prices in December 2023 compared to the previous year. Non-food goods increased in almost all product groups, with the exception of books and media, which decreased in price by 1.3 percent during the past month.

White goods increased on inflation and increased construction costs as a result

The prices of white goods (4.1 percent), clothing (2.9 percent), shoes (2.7 percent), bicycles (2.3 percent) and household utensils (1.5 percent) increased the most. Leisure goods, home electronics and tools also rose in price during December, according to the latest inflation statistics from Statistics Sweden.

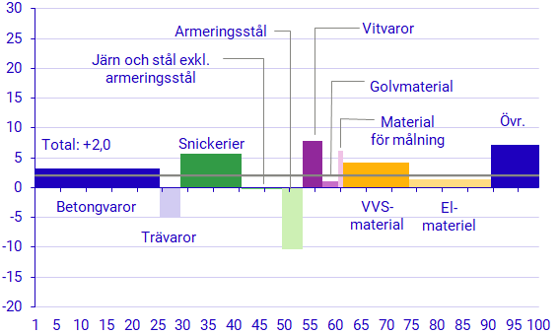

Construction cost index for various construction materials December 2022–December 2023. Source: Statistics Sweden

Among construction contractors' costs, material costs rose by 2.0 percent between December 2022 and December 2023, Statistics Sweden reports. The costs for white goods and other building materials increased the most, by 7.9 and 7.2 percent, respectively. All other material costs showed lower increases, except for the costs for reinforcing steel and wood products, which even fell by 10.3 and 4.9 percent, respectively, and the costs for iron and steel including reinforcing steel, which fell by 4.8 percent.

Not surprisingly, white goods lead the inflation league

– The increases in the electronics tax, which have affected consumers and home builders when purchasing white goods and are now driving up inflation, do not come as a surprise, says Kent Oderud, chairman of APPLiA.

– The very high increases in tax collection in 2023 and 2024 for white goods and home electronics now ensure that these product groups are driving inflation in Sweden.

The electronics tax is the "culprit"”

Increases in the electronics tax on January 1, 2023 were made by 8 percent and at the turn of the year 2024 by a further 9.1 percent. In the meantime, on July 1, 2023, the deduction option was removed for white goods and home electronics with reactively added flame retardants in electronics. This meant that the tax collection increased by between 45-50 percent in one fell swoop.

– Of course, this tax affects the price for consumers, home builders and other buyers of white goods. In addition, it drives inflation, as SCB: statistics clearly show, continues Kent Oderud.

At the beginning of 2024, the total tax amount paid by the consumer for, for example, a dishwasher at the normal price level is between 12-13 percent of the final price, corresponding to just over SEK 660 including VAT. The electronics tax is therefore subject to VAT.

– An ineffective special taxation, which drives inflation, in the middle of a situation where inflation must be fought by all means. It is regrettable that our politicians have not acted earlier and more forcefully to remove this tax when the effect clearly proves to be ineffective for the environment and negative for the economy, concludes Kent Oderud.

Monitoring the negative consequences of the Electronics Tax and lobbying to abolish the tax is one of APPLiA's most important focus areas. Follow us on our channels to stay updated on our continued work!