2022.11.08

Chairman's reflection after announcement about the electronics tax

Today the government's first budget after the Tidö Agreement was presented. In opposition, the Moderates and the Sweden Democrats had promised to abolish the Electronics Tax upon a change of government, a promise that now looks set to be broken with today's budget announcement. Read APPLiA chairman Kent Oderud's reflections after the announcement below.

Despite years of criticism from the current government parties and its supporting party against the electronics tax, the new government has now chosen to present a budget proposal that laconically and surprisingly announces that "The government does not intend to abolish the tax.".

It is of course remarkable that the government chooses not to abolish the tax in the budget for 2023, but even more remarkable that it writes that it does not intend to abolish the tax either. Years of criticism of this tax from all the parties that now form the government's basis (and which was called an unjustified "punitive tax on white goods and home electronics" in the parliamentary debate on GDP indexation just a few days ago), now suddenly also becomes a fiscal tax with the new government in the future.

”The "penalty tax" continues

Criticism from the authorities, the business community and the industries has been ignored regarding the tax's non-existent impact on environmental improvement, its complexity for compliance, the expensive administration for companies, the authorities' poor control and the tax's inflationary effect on consumer prices. Read our latest contribution together with ElektronikBranschen "The government must stop penalizing electronics taxation" from November 8 here. The criticism from APPLiA and other organizations will therefore not stop.

Taxes are being raised sharply

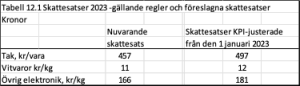

The new tax rates for the beginning of 2023 are ready. The tax will be calculated with the CPI at the turn of the year – and there will be no small increase this time – the maximum ceiling of SEK/goods and SEK/kg of goods weight will be increased by just over 8 percent.

Every change in the electronics tax generates extra work and administration for all companies in the industry that are registered warehouse keepers or have other status with the Swedish Tax Agency. And in the future, the annual increase will not be enough. Most of the changes will increase the burden and costs.

Every change in the electronics tax generates extra work and administration for all companies in the industry that are registered warehouse keepers or have other status with the Swedish Tax Agency. And in the future, the annual increase will not be enough. Most of the changes will increase the burden and costs.

Next change July 1, 2023

The government is now proposing in the budget to remove the difference in terms of deduction possibilities between additive and reactive flame retardants. For companies, this means an automatic tax increase. This is because the previous deduction possibility for reactive flame retardants is disappearing. The government is aware of this and writes in the budget

”"”Some consultation bodies, including APPLiA, the Electronics Industry and the Confederation of Swedish Enterprise, have pointed out that the change, if combined with unchanged or increased tax levels, would mean increased tax revenue. The memorandum assessed that the tax amounts per kilogram and the maximum amount per item needed to be adjusted downwards to maintain the general tax level.. The government agrees with that assessment.”.

The government is therefore proposing an adjustment for this by once again adjusting the tax rates on 1 July 2023 and reducing them to 11 SEK/kg for white goods and 160 SEK/kg for other electronics. The "ceiling" for the tax will then be adjusted marginally to 489 SEK per item (plus VAT of course) on this date.

More changes

An update on which goods are to be taxed will take place with a set of renewed CN codes (customs codes) on July 1, 2023. The updated CN codes may in some cases mean a difference in which goods are covered.

In addition, changes regarding private imports will take place as early as February 13, 2023 in the provisions on Rules for certain imports and unauthorized entry.

You can find the full budget proposal via this link. link. The Electronics Tax/Chemical Tax is addressed with all proposed amendments on pages 214-239. here..