2023.05.24

Report shows: more efficient RUT deductions are needed

The flat-rate deduction for repairs of white goods was introduced in 2017. The industry organization APPLiA annually monitors how this deduction is used for repairs of refrigerators, freezers, washing machines and the like in Swedish homes.

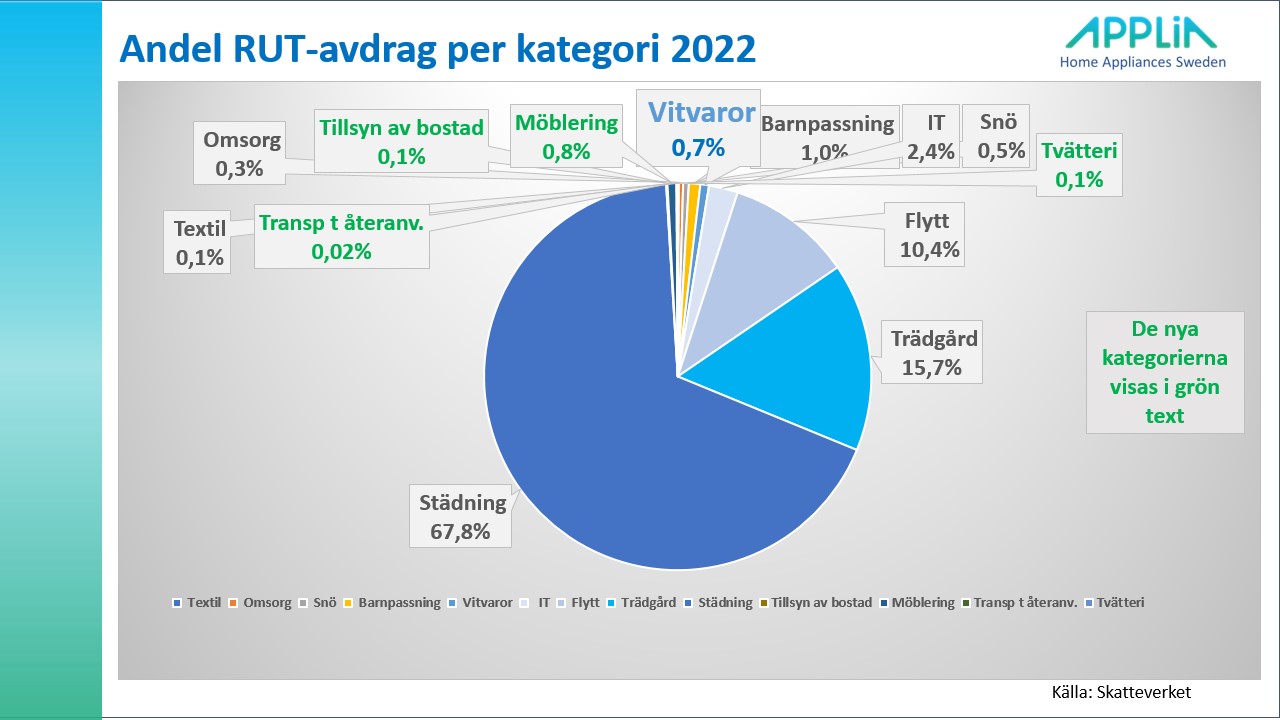

Some new categories have been added to the RUT system since 2021 – see green text in the diagram above. Of these, the category of furnishing and furniture assembly has succeeded best in gaining turnover. This category has quickly surpassed the repair of white goods and landed at SEK 57 million in 2022.

Some new categories have been added to the RUT system since 2021 – see green text in the diagram above. Of these, the category of furnishing and furniture assembly has succeeded best in gaining turnover. This category has quickly surpassed the repair of white goods and landed at SEK 57 million in 2022.

Of the new categories, tThe transport of household goods and chattels for sale and reuse received the least response, with only 0.02 percent of the total tax deductions paid out.

Circular behavior requires a more efficient square deduction

Apart from the major categories (cleaning, gardening, moving services), none of the other deduction categories have yet had any major effect on their original objectives.

Increased use of the deduction for repairs of white goods could contribute positively to increased circular behavior among Swedish households. If the deduction were more relevant for these repairs, a significantly larger number of household appliances would be repaired instead of being replaced with new ones. Now, instead, these are decreasing down to 0.7 percent of the total square deduction in Sweden and we must change that.

Sharp proposals for increased circularity

APPLiA has therefore put forward sharp improvement proposals in consultation procedures and other contexts, which would in turn influence the willingness to repair and service white goods. This would make a significant contribution to the circular society.

Read about these sharp proposals and the complete PDF report on the 2022 square deduction here: Applia report RUT deduction 2022

Text: Kent Oderud