2023.06.08

This is how retail and the industry fared in April

Gloomy figures in the trade and locked-up capital among consumers. Now the latest statistics for the retail trade and the white goods industry have been compiled. Applia brings you the analysis and future prospects.

Households amortize

Household consumption is now declining in all the sectors that reached record levels during the pandemic. Particularly notable are consumer electronics, household appliances, construction materials and furniture, which were often consumed with borrowed or saved funds but are now finding new ways. Large extra amortizations have been made on mortgages in Sweden to reduce households' interest burden. Swedbank announces that almost SEK 15 billion was amortized in the entire Swedish economy during the first quarter of this year. This corresponds to an increased amortization rate of more than 1 percent of the total mortgage stock.

Households save

In addition, households transferred over SEK 18 billion from easily accessible bank accounts to fixed-term savings accounts during the past quarter, where the money is locked up for a longer period of time and generates interest. Overall, there is a lot of consumer capital that is found elsewhere than in the cash registers of luxury goods retailers.

Heavy volume loss in the luxury goods trade

Statistics Sweden's latest report on retail development, this year compared to April 2022, is not cheerful reading either. HThe Swedish retail sales volume hasnskat by 6.5 percent, grocery retail by 4.5 percent and non-durable goods retail by a full 8.3 percent.

Price increases keep turnover up

In terms of trades turnover, The high rate of price increases is helping the entire retail trade to increase its turnover by 2.6 percent, compared to April last year. In other words, a result of higher prices. In the grocery trade, turnover increased by a full 9.3 percent. In the non-durable goods trade, however, things were bleak with a decrease of 1.6 percent – despite inflation.

Sales volumes are thus falling more than price increases, which has led to inventory buildup in companies and large sales losses. At the same time, costs are rising, which is why the balance sheet in companies is becoming increasingly important for resilience the longer the consumption crisis continues.

White goods follow the trend

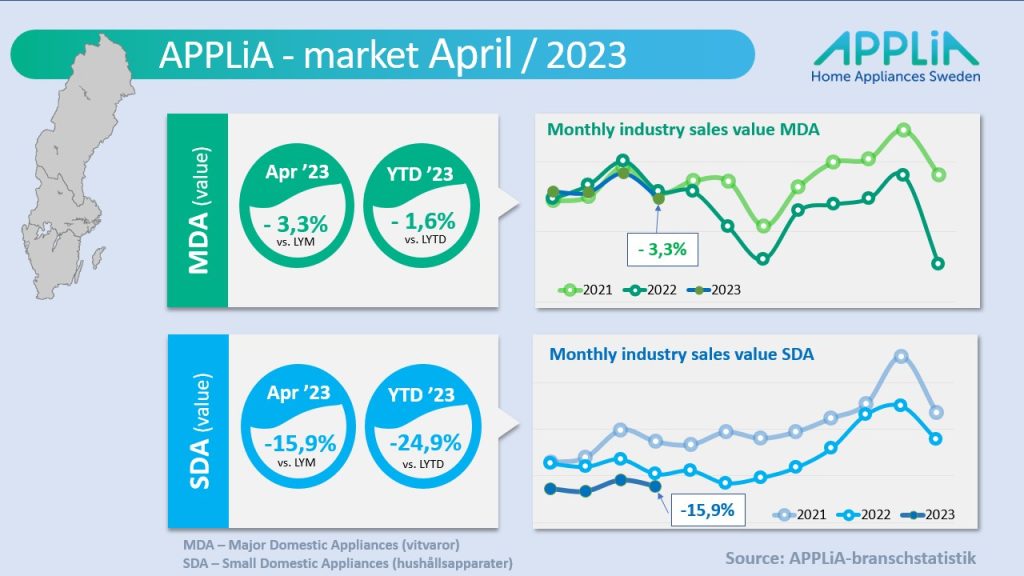

Major appliances (MDA) follow the trend we see in Statistics Sweden's quarterly report for durable goods and are now 1.6 percent below last year's level accumulated for the year. in terms of value. But just like in other retail sectors, it is price increases that keep sales up – volumetrically The MDA segment is losing approximately 15 percent during the first four months of the year compared to the previous year.

Household appliances (SDA) showed a slightly improved downward trend during the month of April compared to previously. This contributed to a modest increase in the accumulated outcome in terms of value to 24.9 percent compared to last year (27.5 percent last month). For SDA too, the volume loss is greater than the turnover loss.

Weak improvement for the industry

Overall for the APPLiA industry (MDA+SDA), the comparison figure compared to the previous year now stands at a 6.8 percent accumulated decline – a slightly better result than at the turn of the quarter, which was minus 7.1 percent.

Unclear future developments

How this will continue during the year is very uncertain to predict – not only for our industry, but also for the economy in general. A long-awaited recovery is probably a long way ahead of us. If we are to believe the statements of HUI and other experts, it will be until 2024 before we can see a positive change. For example, Ola summarizes this as follows Nevander in Market Macro Analysis mode:

”"However, most growth forecasts – despite inflation, war and other misery – paint a relatively positive picture of the recovery from 2024 onwards. The IMF believes that important markets for trade such as Norway, the Netherlands, the US and China will also do reasonably well this year. Sweden, Germany and the UK, on the other hand, are expected to report negative GDP growth due to exceptionally high inflation, cyclically sensitive business and specific domestic imbalances.".

The future development of the APPLiA industry in Sweden will be largely determined by the macroeconomic events described above, but also by what happens to the Swedish currency and the slowing pace of new housing production. So Ola Nevander's final words apply:

”"Although no single actor controls the course of events, the rapid fluctuations should prompt reflection and creativity rather than passivity. Those who keep a cool head and can imagine what could happen next can gain an edge over their competitors, in a way that paves the way for relevant innovation.".

//Kent Oderud