2023.09.20

Chairman: The government was wrong

The day before yesterday, the Swedish Tax Agency published data on declared chemical tax for the most recently reported month of July, compared to July of the previous year. It was very interesting reading for us critics of the tax itself and the changes to it that took place on July 1 of this year.

You could read about APPLiA's criticism of the change in July here in APPLiAnytt earlier: Lower tax rates result in higher tax collections – APPLiA (applia-sverige.se). Now, based on the published real figures, we can emphasize that the government was completely wrong – APPLiA and other critics were right!

The right to deduct was changed

Previously, suppliers could make tax deductions for so-called reactive added flame retardants in electronics. At the turn of the first half of this year, this deduction option was removed, even though reactive flame retardants had previously been considered the least bad solution for effective flame protection in electronics, unlike the additive The added flame retardants were considered a poorer solution. The incentive to change, where possible, thus disappeared.

RThe report for July gives the results

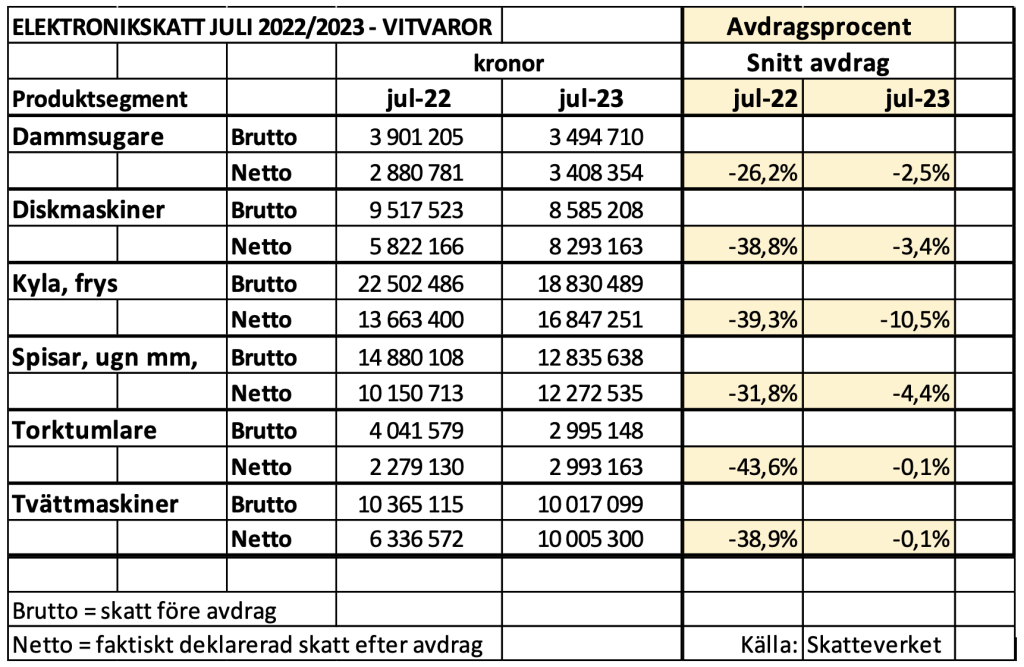

July is the first month with the new rules regarding tax deductions. Therefore, the comparison of tax collection between this month this year and last year is particularly interesting, as it shows that tax collection is increasing dramatically – despite the government's stated ambition in the autumn budget that tax collection would not increase due to the change in the right to deduct.

What does our July result say then?

The results from July show that APPLiA and the Electronics Industry's calculations before the change came into force were completely correct. The calculations of the government and Ministry of Finance officials before the decision were completely off the mark and apparently taken out of thin air. It now turns out that the decision was made by the Riksdag on completely incorrect grounds.

Heavy tax increase

For the heavy product segments washing machines and dryers, in principle no deductions are made after July 1. Last year, the average deductions were around 40 percent and this year in principle zero percent. This means that each washing machine and/or dryer has now increased in price by up to just over SEK 600 incl. VAT when sold to a consumer. The corresponding loss of the possibility of deduction for the other white goods segments is also significant and is shown in the table above.

The situation is similar for other consumer electronics products, such as TVs and monitors. These go from a 50 percent discount in July 2022 to just under 7 percent in July 2023.

Inflationary

Overall, the results from our review of the July figures suggest that the total estimated tax collection from the electronics tax will now increase to SEK 2.6 billion on an annual basis from SEK 1.6 billion in previous years before the change in the deduction options. This affects consumers in Sweden but not in any other country. This without any environmental impact having been achieved, which undermines the credibility of the entire Swedish environmental policy.

Reduce or eliminate

Now it is up to the government to live up to its promise in the budget bill for 2023, which clearly declared that these changes not would increase tax collection. As compensation, the tax was then reduced on July 1 by an insufficient 1.6 percent. This now turns out to be a sham maneuver – which was not nearly enough to compensate for the loss of deduction opportunities. Rather, a 40-50 percent reduction in tax rates would have been what would have been needed for the government to be able to keep its promise in the budget decision.

It would be best to abolish this punitive tax on white goods and home electronics and invest wholeheartedly in legal restrictions on the current flame retardants throughout the European internal market, which would have an effect.

Text: Kent Oderud