2025.02.10

Now it's confirmed - the electronics tax makes things even more expensive

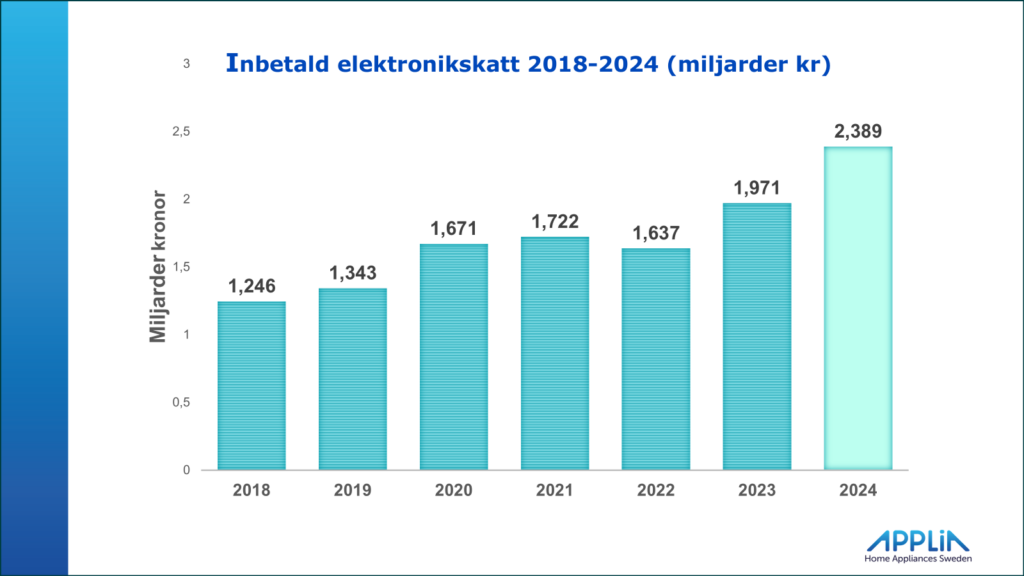

The Swedish Tax Agency has now added up the billions declared for electronics tax to the authority in Sweden during the full year 2024. The large increase in tax collection that was implemented on July 1, 2023 now appears to have a full impact on the full-year figures for 2024. APPLiA's chairman Kent Oderud comments on the year with the Electronics Tax.

Despite a decline in sales of, among other things, white goods (which are covered by the electronics tax) by just over 8 percent, tax collection will increase by a full 21 percent to 2.4 billion in 2024 compared to the previous year.

The sharp increase during the year is due to the abolition of the right to deduct reactive flame retardants at the end of the first half of 2023. In addition, the tax rates were indexed as of 1/1/2024.

Since its introduction in July 2017, the electronics tax, with this year's 2.4 billion, has now brought in a total of 12.7 billion kronor (plus VAT of course) to the Swedish Tax Agency. And made it more expensive for consumers, construction companies, schools and others to buy white goods and home electronics. And there is still criticism from the industries, authorities and experts against the unsustainable form of the special taxation, which is described as pure political green-washing by the critics – with no effect on the substitution of the necessary and prescribed flame retardants in all electronics. The Swedish market is simply too small for global electronics manufacturers to research suitable substitutes. Common regulations within the EU are needed here to have an effect.

Administrative burden

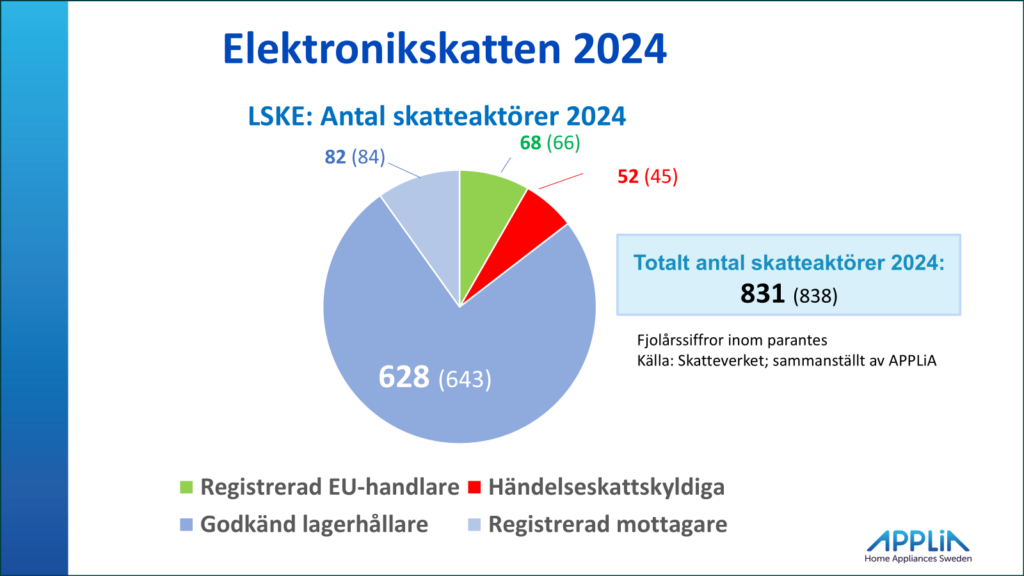

There are over 800 tax actors (companies, importers, suppliers, traders, etc.) who must manage an administrative burden together with their international parent groups, manufacturers and specialists to handle the tax return documents and follow-up on them.

It is noteworthy that the number of approved warehouse keepers is slightly fewer in 2024 than the previous year. This is likely due to a number of operators who have closed down operations or reformed their business concepts. However, there is an increase for those who are ”incident tax liable” – often private individuals who have purchased goods from another EU country or third country. If we compare this with all the shipments of home electronics that are flowing in from China and other countries, 52 people who have declared electronics tax is vanishingly small. How small is shown in the next image – see the numbers marked in red.

Who pays the electronics tax and who pays almost nothing?

Approved warehouse keepers, which include companies in various parts of the industry, account for more than 98 percent of the electronics tax reported to the Swedish Tax Agency. It is clear that EU traders have not really been given the green light to declare electronics tax for their sales to customers in Sweden. They account for a vanishingly small part of the tax payments (0.5%).

We note that Swedish-based companies in the supply, distribution and trading sectors account for the overwhelming majority of tax revenues, while the relatively non-existent tax payments from actors outside the jurisdiction of the Swedish Tax Agency give Swedish-based actors a strong competitive disadvantage. And Swedish consumers are the ones who pay the price!

Upcoming annual report from APPLiA

Look out for APPLiA's fully compiled annual report on the effects of the electronics tax in Sweden, which will be released in February.