2025.04.30

Market development in the first quarter

The industry's sell-in figures for the first quarter of this year show some recovery for larger appliances, while smaller household appliances are still well behind the corresponding period last year.

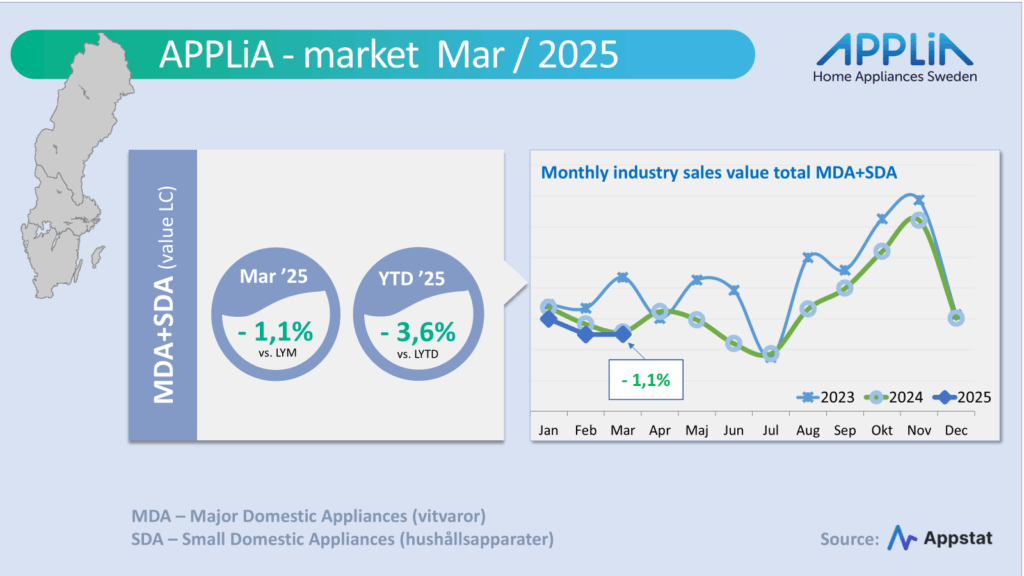

The industry as a whole does not reach last year's level

The first quarter of the year ended with a loss of minus 3.6 percent for the first three months of the year for the overall APPLiA industry. Nevertheless, the monthly figure in March (-1.1%) improved slightly on this quarterly figure, as both January and February showed worse comparative figures this year compared to their corresponding months in 2024 than what was shown in March.

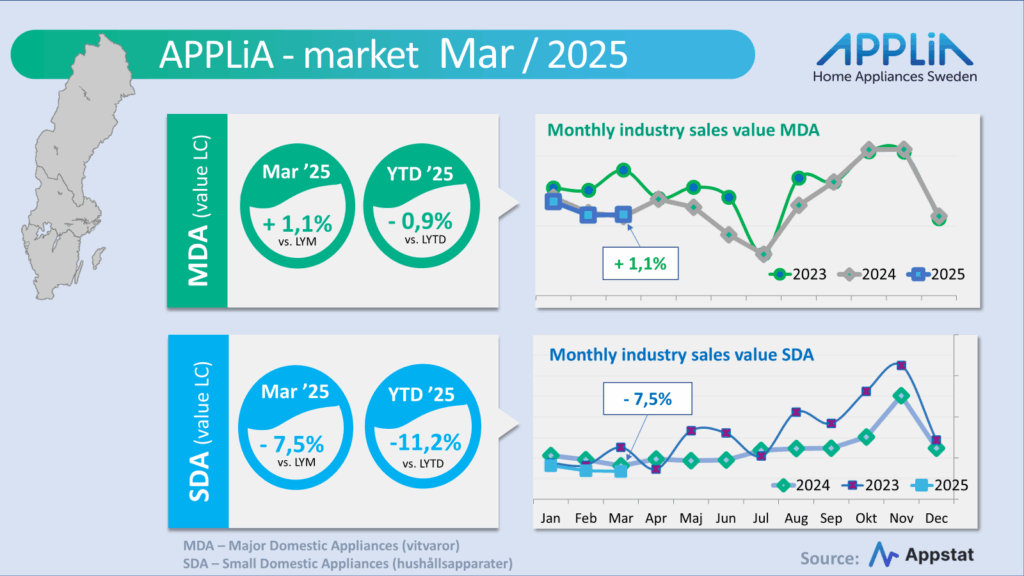

White goods (MDA) pluses

The larger industry goods (MDA) made a small plus (+1.1%) in value terms in the month, which helped to almost reach last year's figure for the first quarter of this year. This despite a decrease in housing construction in Sweden and a tough retail climate. Now all that is needed is a boost for the volume figure, which for all MDA segments combined is currently at minus 3.2 percent, before we proclaim that "the bottom has been reached, now things are turning up for white goods"!

SDA still in the red

Household appliances (SDA) have not yet recovered from the boom that occurred during the pandemic and immediately afterwards. Swedish households seem to have stocked up on coffee machines and other goods during this period. This has hit sales hard. In terms of value, the quarter ends up being minus 11.2 percent worse than 2024.

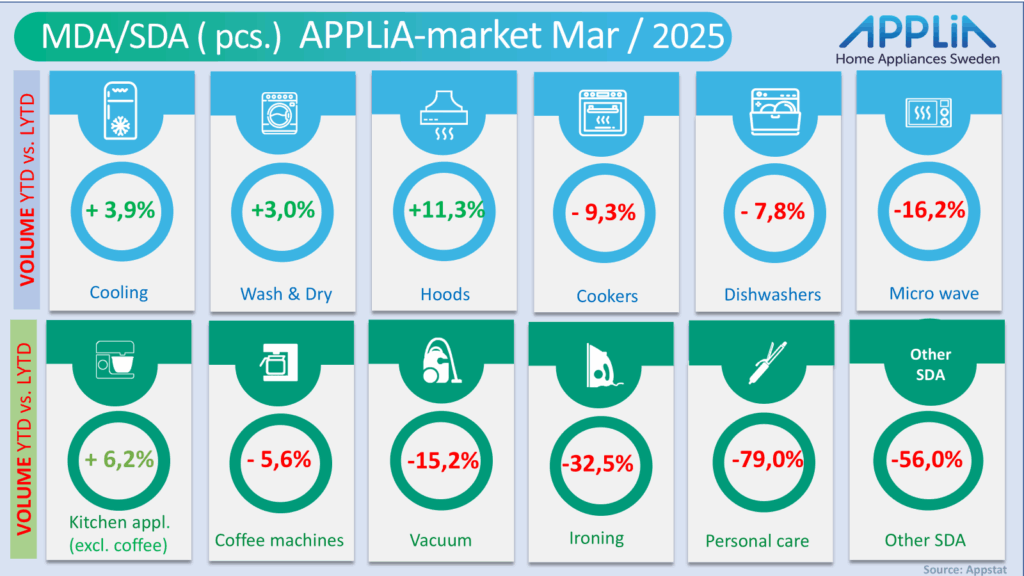

Volume development remains negative…

… but there are positive signs among some of the product segments. Refrigeration and freezing products, washing machines and dryers and range hoods are rolling along with positive figures within MDA, while it is ”Kitchen appliances” with, among others, kitchen machines, mixers, waffle irons and kettles that show positive volume figures within SDA for the first quarter. Coffee machines and vacuum cleaners, on the other hand, are down by 5.6 and 15.2 percent respectively.

Ahead of the second quarter

We have now entered the second quarter and there are a number of external factors that can help increase the pace for companies in the industry; a strengthened krona, lower inflation rates and also an increased RUT deduction, which can provide positive impetus to an increased number of kitchen and laundry room renovations.

However, so far we only have reports from statistical institutes about continued weak sales trends in the consumer durables and home equipment trade, which may need to gain more momentum before we can see a significant upturn again.