2026.01.15

Tough development in the APPLiA market

Larger appliances are withstanding the downturn better than smaller household appliances, where the value is being squeezed significantly compared to last year.. Technological development and energy efficiency are clear drivers. Consumers prioritize smart and sustainable solutions, which benefits segments such as connected refrigerators and energy-efficient washing machines.

Market Development / APPLiA Market November 2025

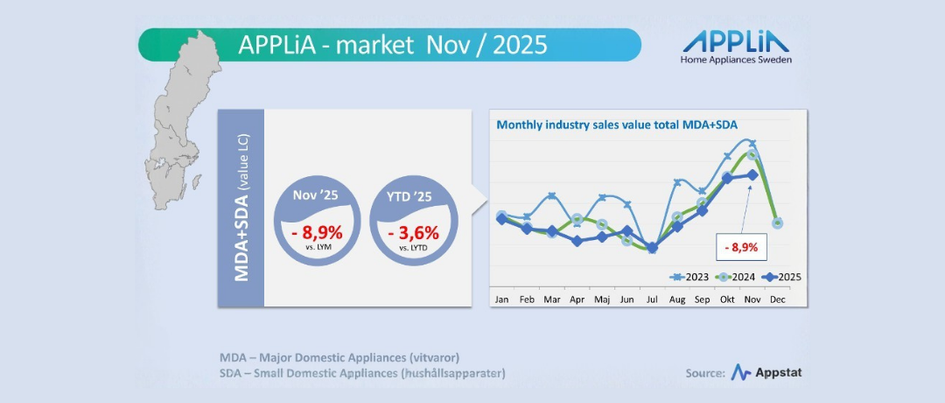

November is traditionally the strongest month of the year for sales of white goods and household appliances, and that was also the case this year. However, overall sales did not reach the levels of the previous year, taking a significant step backwards by a full 8.9 percent.

The industry has seen some positive signs, including improved macroeconomic conditions such as lower interest rates and inflation, as well as reduced financing and material costs for home construction and renovations. Despite this, the overall outcome for the industry so far after 11 months in 2025 is now 3.6 percent lower in value than in 2024.

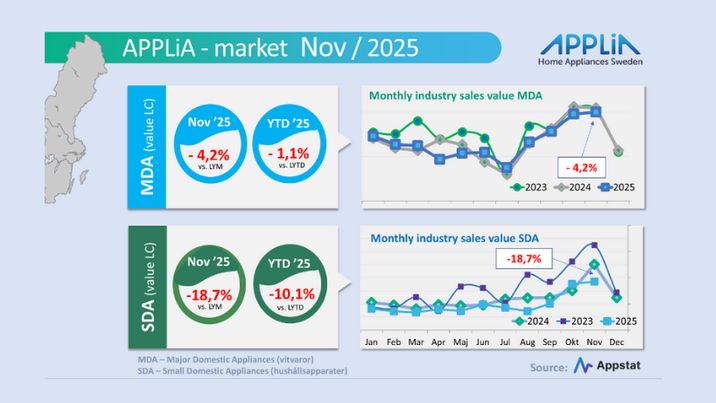

MDA is doing better

Major appliances (MDA) have had a relatively stable development so far in 2025 and show a value comparison just below the previous year of minus 1.1 percent. This while smaller household appliances (SDA), with an accumulated minus 10.1 percent, are dragging down the industry's total figures.

MDAs: During the past 11 months of the year, there are two main segments that show positive value figures; Hoods (kitchen hoods) and Cookers (stoves, ovens, hobs, etc.), while the other main segments within MDA are just below last year's value.

SDA: Most of the main segments within smaller household appliances show negative figures compared to the previous year – only "Kitchen appliances", which includes kitchen machines/assistants, mixers/juicers, toasters/table grills and kettles, shows a cautious positive development compared to 2024.

Trends that guide development

Although the overall market development has been hampered by various uncertainties in society, the market for smart appliances is growing rapidly. A full 25 percent of Swedish households now have at least one smart appliance or household appliance – an increase of 15 % in one year. Driving factors are AI, voice control and connected systems that make everyday life easier and more energy efficient.

Energy efficiency remains in focus, with new EU requirements and technical innovations such as heat exchanger technology, improved eco modes and heat recovery. Consumers are increasingly demanding appliances that are energy efficient and connected.

Market climate and future prospects

The November trade barometer shows that future expectations in the retail sector are cautiously positive, especially in the grocery sector. For consumer durables, which includes white goods, the outlook is unchanged but with some glimmers of hope for developments in 2026.

Macroeconomic factors such as lower interest rates and inflation are providing some support, but the recovery is slow and the industry must continue to navigate an uncertain environment. Despite these positive signals, the industry continues to be pressured by weak purchasing power and uncertainty about profitability and employment, as well as low housing production.

//Kent Oderud