2022.11.15

Swedish Board of Housing, Building and Planning: Race for housing construction next year

The Swedish National Board of Housing, Building and Planning has issued a gloomy forecast for new housing production in the coming year. Total investments in housing, premises and facilities in Sweden are expected to shrink by almost ten percent next year, which is comparable to the figures from the financial crisis in 2009 when they fell by approximately SEK 121.3 billion.

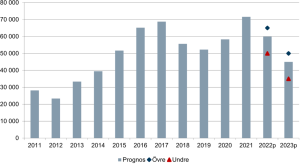

The Swedish National Board of Housing, Building and Planning writes in its report: "In 2022, start notices will be given for the start of 60,000 homes according to the Swedish National Board of Housing, Building and Planning's revised forecast, of which 57,000 through new construction and 3,000 net additions through renovation. This is 14 percent fewer than the peak year of 2021, when just over 71,000 homes were started.".

As a forecast comment for next year, the Swedish National Board of Housing, Building and Planning announces: "In 2023, approximately 45,000 housing starts will be started according to the forecast, of which 42,500 through new construction, a decrease of another 25 percent. However, the actual number of housing starts may be lower than what the start notices show in times when the housing market slows down.".

The industry organization Byggföretagen also expects in its latest forecast that 38,600 housing units will be started in Sweden in 2023. Compared to 2021, when 67,800 housing units were started, this would mean a decline of more than 40 percent between these two years.

It may also be just the tip of the iceberg, as a start notice does not necessarily mean that house construction will actually begin. Many construction companies put their shovels in the ground, but are content with that and wait for better times, they write in their report.

Worse times

Total investments in housing, premises and facilities in Sweden are expected to shrink by almost ten percent next year. During the financial crisis in 2009, they fell by around 12 percent, by comparison.

Above all, it is housing construction that is now declining due to high interest rates, inflation, falling real wages and generally higher prices for building materials.

Employment in the construction industry is forecast to decrease from 341,500 people in 2021 to 319,000 in 2023 – a decrease of 22,000 people.

The forecast also depends on how the mining permit for Slite för Cementa in Gotland, which controls the supply of cement and concrete, goes. The current permit expires at the end of December this year. This means that it will be uncertain what will happen to the cement supply in 2023.

Sales of housing slopes

The situation during the autumn indicates that sales of newly built homes are declining. This is evident, among other things, in Boolis' statistics, where the number of unpublished advertisements for newly built homes is falling sharply, especially in Malmö and Gothenburg, but also in Stockholm.

In this situation, it is impossible for home builders to compensate for the increase in costs of materials and transportation by raising prices for new production.

The fact that small house manufacturers are also struggling is confirmed in the Swedish Wood and Furniture Companies' market report. Order intake for January–September 2022 for small houses decreased by 43 percent to 2,695 houses compared to the same period last year.

Affects the white goods market

Overall, this is an equation that simply does not add up for home builders. And neither for the supplier companies – including the white goods companies that supply kitchen and laundry equipment to newly built homes. The volume loss, which occurs due to the decline in new home production, is estimated at approximately 60-75,000 units in 2023, distributed across the various white goods categories.

But there is hope. For the Swedish National Board of Housing, Building and Planning ends its rather gloomy forecast by looking ahead to a brighter 2024 and writes:

”"In the long term, we see opportunities for a certain upward turn in the construction pace, influenced by falling construction prices, an expected stronger economic situation in 2024 with significantly rising real incomes, and a decrease in the uncertainty that currently affects both demand and supply."”

Text: Kent Oderud

Source: Swedish Board of Housing, Building and Planning

Source: Swedish Board of Housing, Building and Planning