2023.10.25

Cash is no longer King

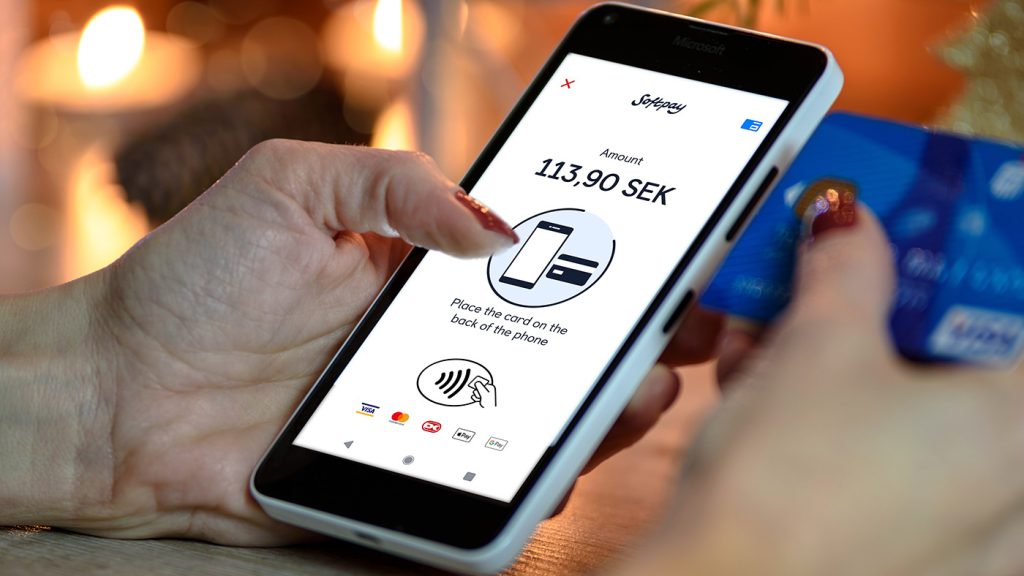

Almost half of Sweden never uses cash. The Nordic region is a world leader in digital payments, in several ways. The historic paradigm shift of the last two years, when mobile payments have become more popular than cash, is confirmed in Nets Nordic Payment Report.

46 percent of Swedes never use cash as a means of payment when shopping in physical stores, according to a consumer survey in Nets' latest payment report. Mobile payments are now the second most preferred payment option, after card payments, when Swedes shop in physical stores. Swish is most popular, but Apple Pay is growing the most.

– It is a remarkable development we are seeing when it comes to Swedes' use of cash. We have gone from having wallets with cash, to wallets without cash and now increasingly have no physical wallet with us at all, says Louise Richardson, Sweden Manager at Nets.

The use of contactless payments has increased strongly across the Nordic region in recent years, with around 90 percent of consumers using the payment method. A clear majority of Nordic consumers consider mobile payments to be an electronic wallet solution – primarily Swish in Sweden, Vipps in Norway and MobilePay in Denmark.

Swish dominates with 59 percent of contactless payments, Apple Pay accounts for 15 percent, while Google Pay and Samsung Pay have 3 percent each.

Cards top the list

Cards as a means of payment in physical stores dominate trade. Sweden has a very well-developed infrastructure for card payments, just like our Nordic neighbors. 56 percent of Swedes use card payments daily.

In the first half of 2023, contactless payments accounted for 86 percent of all card payments in Sweden. At the beginning of 2020, contactless payments accounted for only 43 percent of all card payments in Sweden, and at that time two-thirds of Swedes did not use the payment method at all.

– From a ten-year perspective, there has been an enormous development. Previously, cash and card payments dominated in physical stores, but the development of the two payment methods has gone in completely different directions. We have gone from cards with a PIN code to chip cards without a PIN code, that is, contactless card payments, and today more and more cards are in mobile phones. The number of card-based transactions has increased extremely much, while cash has gone in the opposite direction with radically fewer transactions. In many ways, this development is good, but there are also challenges for a number of groups that have difficulty in digital development and here we need to find good solutions, says Bengt Nilervall, payment expert at Svensk Handel.

Net's new report, Nordic Payment Report, can be downloaded here.