2022.12.20

The electronics tax – this is happening in 2023…

On December 13, the Riksdag adopted the budget bill containing the changes to the electronics tax that had already been announced by the previous government.

Previously, on October 26, the Riksdag had said no to an annual over-indexation of 2 percent in addition to the annual CPI indexation that applies to the electronics tax. The parties that voted against the over-indexation also verbally saw the electronics tax as a target in the Riksdag debate. Nevertheless, the tax remains and will now be raised significantly in 2023, starting in January with an inflation increase of 9 percent. See previous posts in APPLiAnytt here. Changed tax rates / electronics tax – APPLiA (applia-sverige.se)

The ”simplified” electronics tax will have major consequences

What is striking about the budget bill is that the previous government's proposal to "simplify the chemicals tax" will now be implemented by the new government in its entirety, effective from July 1, 2023. This was completely unexpected for all of us who have followed the debate about the electronics tax since it was introduced.

The biggest impact on tax collection is the decision to remove the distinction between additively added flame retardants and reactively added ones. The presence of reactive flame retardants has so far provided the opportunity for a deduction of 50 or 90 percent from the tax. The deduction existed because it was considered less environmentally damaging with reactively added agents. Now that opportunity is disappearing and taxpayers in the white goods industry now expect to pay full tax – without being able to make deductions from July 2023.

Government: "the changes must not lead to increased taxes"”

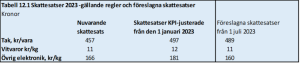

Admittedly, government officials knew that tax collection would thus increase and have therefore calculated a "compensation" in the form of some minor adjustments to the tax rates from this date. See the right column below:

”The ”compensation” is, however, unrealistic and will not do justice to the government’s ambition that the ”simplification” should not lead to increased tax collection. In our detailed meetings with the officials who carried out the calculations that the government relies on, it turns out that their calculations are based on estimates and loose assumptions. The Swedish Tax Agency and Customs have so far been unable to deliver any specific statistics for the deductions for the reactive substances and no contacts have been made with companies in the industry to obtain facts on the matter.

Taxes will increase by SEK 900 million from July

In the budget bill impact assessment, the tax was therefore now estimated to DECREASE by SEK 20 million on an annual basis due to the adjusted tax rates from July. APPLiA and the Electronics Industry's calculations instead show an increase in tax collection by almost SEK 900 million annually! The industry's calculations are based on actual deductions, the tax outcome in 2021 and the companies' own data.

Read more about the calculation in our memo to relevant politicians in the Riksdag's tax committee. here.

Our efforts continue

APPLiA's work together with the Electronics Industry is now continuing to inform newly elected politicians, who do not yet have the electronics tax on their retinas, and to influence decision-makers ahead of the spring amendment budget and the next autumn budget. The policymakers are on our side - but "Finance" is considered to need the tax revenue. Today's 1.7 billion electronics tax will therefore soon become 2.6 billion per year (plus VAT) and contribute to sharply increased prices and fuel inflation! This cannot go on.

Text: Kent Oderud, chairman APPLiA – Sweden