2022.07.04

Experts: Retail will have a good summer – autumn will be more depressing

Last week, the National Institute of Economic Research released a forecast that sharply lowered expectations for the Swedish economy. Inflation, which is the highest in 30 years, is expected to rise further, while household purchasing power is expected to decrease and interest rates are expected to take a significant step upward. Not the best conditions for a successful summer for industrial goods, right?

But if you listen to the expert panel of HUI and the Swedish Trade Council at last week's presentation under the theme "Under what conditions will the trade face the summer", it looks like the shopping spree in the trade will still be able to last during the summer. Right now, consumers want to be out and about doing things. They want to travel, visit amusement parks, buy clothes, organize parties and eat out. In addition, the renovation wave is still strong as it has a longer braking distance. This will probably continue during the summer. However, we will certainly see a slowdown in several areas after the summer. In other words, the autumn may be more depressing according to HUI and the Swedish Trade Council.

Lost purchasing power has consequences

The reduced purchasing power is estimated at just over SEK 4,000 for a family with children outside metropolitan areas and the equivalent of just over SEK 5,000 within metropolitan areas according to HUI's calculations. This will be met with lower savings and less spending in the areas of furniture and home furnishings, renovations, hardware and building materials, consumer electronics, but also travel in the future. The trips that are made now during the summer and autumn are often booked and paid for before inflation took off and interest rates rose. Services will also contribute to the decline in consumption – such as subscription services and services linked to RUT and ROT as well as delivery services such as Foodora and Volt. There will also be an end to unplanned impulse purchases in stores and on e-commerce sites.

APPLiA industry

In light of this, APPLiAnytt can state that the somewhat pandemic-induced market for household appliances is likely to return to levels seen before the pandemic in 2019, while larger appliances will fare somewhat better as large deliveries to new construction and renovations are still in the order books for the next six months.

Repair services will increase

What do the experts point to as areas that will see more positive development despite the gloomy economic outlook? There are sectors such as repair services for home appliances, clothing, consumer electronics, etc. and other sectors that exude sustainability and resource orientation. In general, low-cost players, regardless of industry, are also expected to benefit in the coming months.

“Low prices and second hand will do well, as will repairs,” concluded Per Ljungberg, CEO of Swedish Distance Selling, during HUI's presentation.

But premium products and products with a longer lifespan will also be valued by consumers. The polarization between low price and sustainability will increase.

Physical stores are gaining share

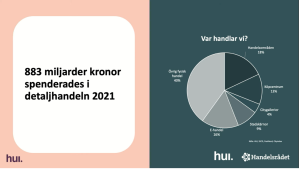

Of the 883 billion that was sold in the entire retail trade last year, 16 percent was online sales. Now, a proportional recovery in physical trade and a recovery in shares is expected in the future. The pure e-retailers are expected to take a harder hit than those with omni-concepts and their own physical stores. But a lot depends on which industry we are looking at, it emerged during the presentation.

All images above are from the Trade Council. Watch the full presentation and panel discussion with the experts (approx. 1 hour) HERE.

/Kent Oderud