2023.11.22

New tax rates – tax increases by 9.31 percent

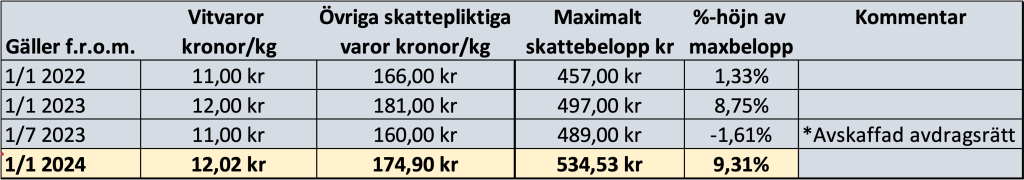

So it's time again – after five months, the tax rates for declaring the electronics tax will be updated again at the turn of the year. This time, it's just over 9 percent index increase that will affect the maximum tax amount per item from January 1, 2024.

One new feature is that this time the Swedish Tax Agency does not round to the nearest kroner amount but allows the amount to be expressed in decimals (=øren).

The new tax rates are shown in the yellow area above. The new level for the maximum tax levy of SEK 534.53 means that the tax rate itself has been increased by just over 63 percent since 2019. In addition, the removal of the right to deduct reactively added flame retardants as of July 1 this year has increased the actual tax levy by approximately 50 percent. If we add these together, the tax levy has more than doubled in a few years, despite the market for both white goods and home electronics having declined sharply in recent years.

Index increase higher than latest CPI

Last week, Statistics Sweden presented the new inflation figures – most indices are based on these figures – and showed a CPI of 6.5 percent. Why isn't this the basis for the electronics tax index increase, which has now landed at 9.31 percent?

The Tax Agency responds: "”The basis for the change in the CPI has been 9.31 percent between June 2022 and June 2023, which are the reference months."” and refers to the budget bill, page 277, where these reference months are explained:

”"The comparison ratio indicates the relationship between the general price level in June of the year in which the conversion takes place and the price level in June of the immediately preceding year.". And further;”The converted tax amounts are rounded to whole kronor and ören.”

Contributes to inflation

Applia notes that this increase to an "over-indexation" compared to the actual CPI development affects the price development of the market's products, which are largely in demand for modernization and energy efficiency in Swedish households.

The washing machine column in the example above shows that the price burden due to the electronics tax alone is over 1,300 SEK on this item, as the electronics tax is also subject to VAT.

Sweden's consumers and home builders will now have to pay an additional approximately 200 million SEK, in addition to the 2.6 billion already paid in electronics tax on an annual basis, without achieving any environmental effect with this Swedish special tax arrangement for internationally produced goods.

Text: Kent Oderud, chairman of APPLiA