2023.04.19

This is how much the electronics tax has cost in 2022

Applia is now releasing its annual report in PDF format on how the Act on Tax on Chemicals in Certain Electronics (LSKE, also known as the electronics tax) has developed. The tax has been in place for five and a half years. During this time, a total tax levy of SEK 8.5 billion has made white goods, vacuum cleaners, TVs, computers, mobile phones, game consoles and other electronic equipment more expensive for Swedish consumers and contributed to rising inflation.

Environmental tax?

The tax was introduced as an “environmental tax” in the summer of 2017, but according to EU rules it is now not allowed to be called that as it has no environmental effect on the production of electronics that takes place globally. The tax has been strongly criticized by all relevant industry organizations but also by the state’s own authorities, the Swedish Tax Agency and the Swedish Chemicals Agency. Despite promises to abolish the tax from the parties that formed the new government, nothing has happened yet.

Read the report here!

The report collects all information in PDF format about how the electronics tax has developed in 2022 and compares it with previous years. The report provides answers to the questions, among others:

- How much electronics tax is paid by the different industries?

- Which industry pays the most?

- Do tax deductions change over time?

- Does tax collection work for foreign actors?

- How will tax collection develop in the future?

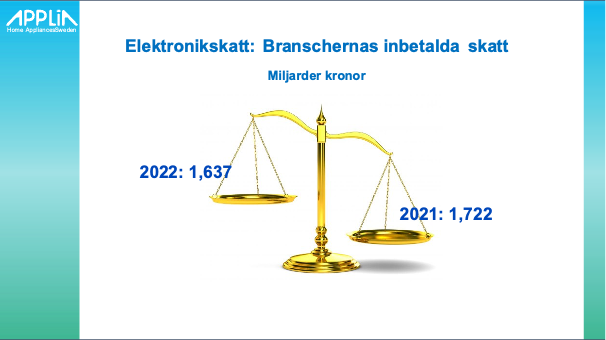

The report shows that the Swedish Tax Agency received payments for the electronics tax in 2022 that are a few percent lower (-5%) than the tax revenue in the previous year. See the scales below:

The marginal decline in tax revenues between 2022 and 2021 is due to the relatively low indexation at the turn of the year 21/22 (<2%) combined with the fact that sales of taxable products have shown a fairly sharp decline during the year. For white goods (MDA), this decline in sales is approximately 10 percent.

The report further states that significant increases in tax collection are expected in 2023 – partly because the indexation implemented follows inflation and therefore landed at a full nine percent from the start of the year. And partly because the deduction options within LSKE are severely limited from July 1, 2023.

/Kent Oderud