2022.03.16

Follow-up of the electronics tax – part 1

APPLiAnytt continues our critical examination of the heavily criticized Electronics Tax (LSKE) and can now present how the treasury has been strengthened by 1.7 billion in extra tax revenue from the affected industries in 2021 – an increase of 3 percent compared to 2020 – without the environmental benefit being demonstrably affected.

APPLiAnytt follows up on how the Electronics Tax has affected our industry and the other affected industries in terms of economic factors such as tax payments and tax deductions during the past year.

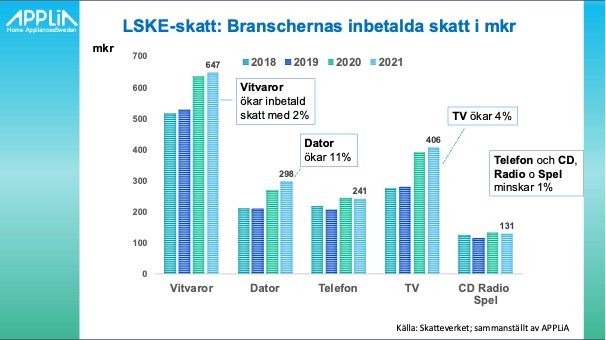

White goods pay the most: 647 million SEK (+VAT)

White goods, including vacuum cleaners, are as usual the largest payer of electronics tax with a total of 647 million kronor, which is almost 40 percent of the total tax payments according to The Act on Tax on Chemicals in Certain Electronics (LSKE). The second highest payments come from TV products, which account for 24 percent of tax payments in 2021.

VAT is added.

Please note that 25 percent VAT is also added to the electronics tax as it is included as part of the product price to the consumer. According to our calculations, white goods would account for just over 800 million kronor extra to the treasury.

Looking back

The electronics tax was introduced in August 2017 and since then the tax rates have been increased by the CPI index at the turn of each year. In addition, the LSKE tax was increased by a full 40 percent in August 2019. This extraordinary increase took full effect in 2020. This has meant that the total tax revenue over time has been:

2018: 1.346 billion paid-in LSKE

2019: 1.343 billion

2020: 1.671 billion (+24%)

2021: 1.722 billion (+3%)

Last year, 1.7 billion was paid to the Swedish Tax Agency, an increase of 3 percent. Then we should remember that the increase in sales in the market was approximately 8 percent AND that foreign e-commerce is also fully liable to tax from 2021. So how has the deduction picture changed?

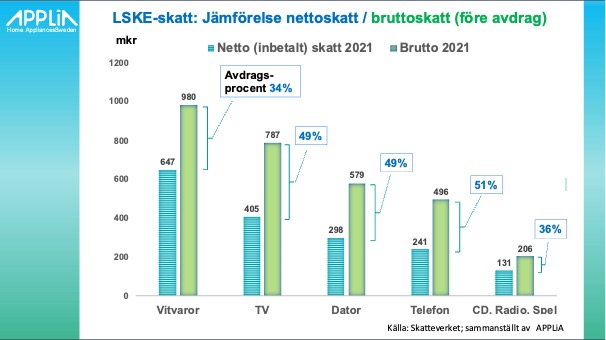

Telephone has the highest deduction percentage (51%)

The deduction percentage is calculated between gross tax (the tax that would have been paid if no deductions had been made) and net tax (the tax that was ultimately paid after 50 and 90 percent deductions).

Telephone is the category with the highest deduction percentage, mostly because this category's 90 percent deduction is 37 percent of its gross tax! The corresponding percentage for the TV category is 10 percent.

White goods have the lowest deduction percentage (34 percent) in 2021.

Changes to the deduction percentage

However, white goods with the lowest absolute deduction percentage show the largest increase during the year; from 29 percent in 2020 to 34 percent last year. Here are all the changes compared to 2020:

The deduction percentage increases for:

White goods, 29% to 34%

Computer, from 48% to 49%

Telephone, from 48% to 51%

CD, Radio, Games, from 32% to 36%

Deductions are reduced for:

TV, from 50% to 49%

No changes to tax deductions indicate that any substitution of the taxed flame retardants has been initiated on any large scale.

To be continued…

In future articles in APPLiAnytt, we will delve deeper into the payments to the Swedish Tax Agency regarding the electronics tax. We will present the payments for the different white goods categories and how the new law on the tax liability of foreign e-retailers has worked (or not worked) in 2021. We will also list the changes to the LSKE that have been proposed politically recently. So, stay tuned if you want to know more!

Kent Oderud, Chairman of APPLiA

Image: Unsplash