2022.03.23

Follow-up of the electronics tax – part 2

APPLiAnytt continues to scrutinize the heavily criticized Electronics Tax (LSKE) and reported in part 1 (which you can take part in here) that the treasury has been strengthened by 1.7 billion in extra tax revenue from the affected industries in 2021. Considering that LSKE has now brought in over 6 billion kronor to the treasury since its start in August 2017, it is only right that it is evaluated cross-wise by several organizations and bodies. APPLiA is one of these.

The white goods industry pays the most

APPLiAnytt reported in the last issue of APPLiAnytt that white goods are the largest paying product category, accounting for SEK 647 million in LSKE tax (compared to SEK 635 million the previous year). This is a full 40 percent of the total payment of electronics tax to the treasury from all taxable product categories. Among the other home electronics categories, TV is the second largest, followed by computers and mobile phones.

Stove/oven/hob/microwave biggest contributor

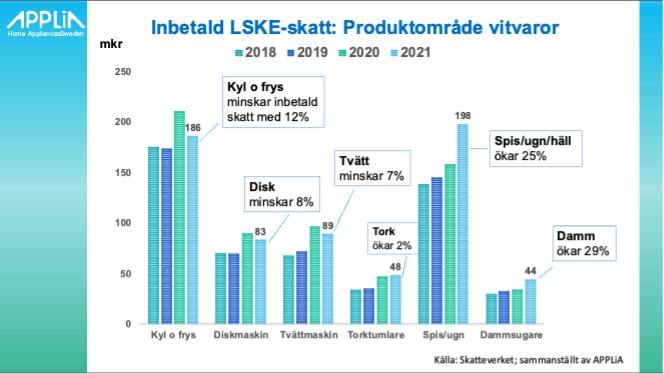

Now we can present in detail how the payments are distributed across the different product categories within the white goods industry and see how they have changed over the years.

The refrigerators and freezers category has been the category that has generated the highest amounts of tax paid in all the years since the introduction of the tax. In 2021, this changed as the stove/oven/hob/microwave category generated almost SEK 200 million in tax payments – an increase of 25 percent compared to 2020 – and takes over the somewhat dubious (!) role of the treasury's best friend.

One component of this increase is that the stove/oven/hob category increased sales volume by 10 percent in 2021, but this is a good way to go to generate the 25 percent increase in tax paid. So apparently other factors have also influenced the higher tax payment in 2021.

Vacuum cleaner tax increases sharply

Vacuum cleaners were another category that significantly increased its share of tax payments (+29 percent), also partly due to an 11 percent increase in sales during the year. However, the amounts paid are nominally significantly smaller for this category because the tax calculation is based on the weight of the goods, not on the actual flame retardant content. And a vacuum cleaner weighs significantly less than a washing machine, thank goodness!

Refrigerators, washing machines, dishwashers reduce tax

If stoves and vacuum cleaners now generate larger payments of electronics tax than in 2021, the opposite is true for other product categories.

• The refrigerator and freezer category reduces tax paid by 12 percent

• Dishwashers decrease by 8 percent

• Washing machines decrease by 7 percent

These changes arise from changes in the deduction percentage for each product group. These are reported below:

Tax deduction of 50 or 90 percent

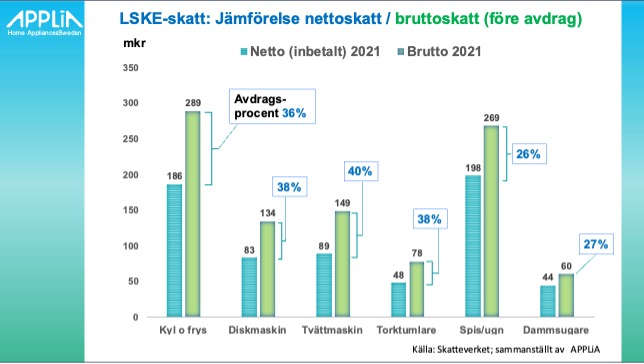

The deduction percentage is calculated between gross tax (the tax that would have been paid if no deductions had been made) and net tax (the tax that was finally paid after 50 and 90 percent deductions). A 50 percent deduction is possible in the absence of chlorine and bromine compounds, and 90 percent when the product's electronics also do not contain flame retardants containing phosphorus.

An account of the size of the various The deductions, 50 and 90 percent respectively, are however made impossible due to the Swedish Tax Agency's current confidentiality rules (which are being appealed by APPLiA fn). The deduction percentages we report here are therefore the combined deductions, i.e. both 50 and 90 percent deductions, as the difference between gross and net tax.

Differences between product categories

The deduction percentage from gross tax within the product category white goods varies from a minimum of 26 percent for stoves/ovens/hobs to a maximum of 40 percent for washing machines.

There are also some changes in the deductions between the different product categories. The largest increase in deductions is made within refrigerators and freezers (from 26 percent to 36 percent). The other changes between 2020 and 2021 are shown here:

• For dishwashers, the deductions increase from 32 percent to 38 percent

• Washing machines increase from 35 percent to 40 percent

• Tumble dryers increase from 33 percent to 38 percent

• Stove/oven/hob remains at 26 percent (same as 2020)

• Vacuum cleaners reduce deductions from 28 percent to 27 percent

We will return with an even deeper analysis of the different product categories and their deduction structure after our appeal to the Swedish Tax Agency has been heard. It concerns the agency's reluctance to disclose specific information on the shares with a 90 percent deduction for three of the industry's product categories. This makes it impossible to carry out a correct evaluation of the effects of the tax.

Very little 'environment' for the money

If we want to assess how effective the electronics tax is in fulfilling its purpose, to reduce exposure to flame retardants based on chlorine, bromine and phosphorus in Swedish households, we do not get a strong indication that this is happening from the figures above. Quite the opposite within some product categories.

Instead, we must rely on the investigations that have been carried out previously by the Swedish Chemicals Agency and the Swedish Tax Agency on behalf of the government. They agree that the electronics tax has not shown any signs that the goal has been achieved or is even on the way to being achieved. However, they claim that it cannot be ruled out that the tax may have some effect in the long term. It is uncertain when or if this can happen, according to both investigations.

EU regulation more efficient

According to APPLiA (and a number of other organizations), increased efforts to change the EU directives that govern the use of chemicals would be significantly more effective. An almost global industry would then drive the issue vigorously together with the EU towards achieving the goal. The drive to achieve that goal is not created by a national, Swedish vested interest in the form of the electronics tax, but by environmental benefits. Since 2017, the tax has made home electronics and white goods more expensive for Swedish consumers by 6 billion kronor (+VAT)!

Kent Oderud, Chairman of APPLiA