2022.03.30

Follow-up on the electronics tax – part 3

APPLiAnytt can now reveal how much (or how little) foreign e-retailers who supply home electronics, appliances and vacuum cleaners to Swedish consumers pay in electronics tax (LSKE) – and it is negligible.

The law that came into effect in October 2020 does not work to reduce competitive distortion!

APPLiAnytt reveals: Foreign e-commerce pays almost no electronics tax

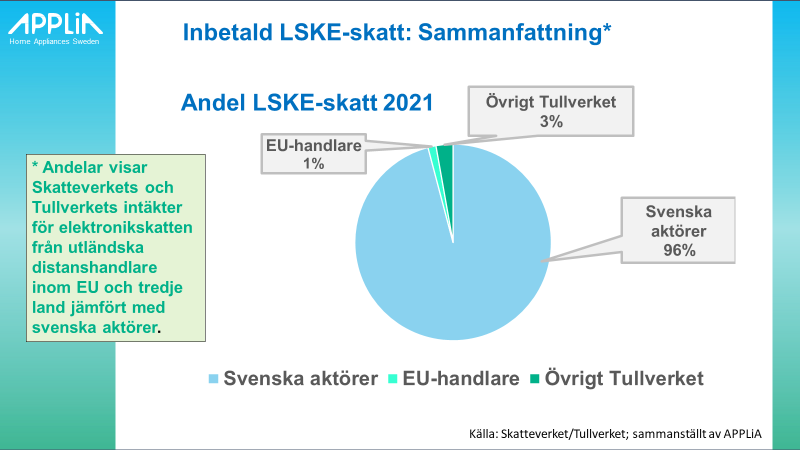

The electronics tax brought in a total of 1.722 billion in 2021 to the treasury. Only a little over 1 % of the tax payments (23 million) come from foreign e-tailers within the EU who have been registered as 'registered EU traders' according to the Swedish tax law. Since October 2020, the law has been in force that makes these foreign e-tailers liable for tax on taxable goods sold to consumers in Sweden. The Swedish Tax Agency now announces that only a minimal share of the total electronics tax comes from these registered EU traders.

Is the authority's control too weak or is, for example, the 'threshold' of SEK 100,000 in annual turnover, which applies to foreign e-tailers who become liable to tax, set too high and completely impossible for the authority to control? Something is definitely missing, which continues to make the electronics tax a difficult competitive disadvantage for Swedish entrepreneurs.

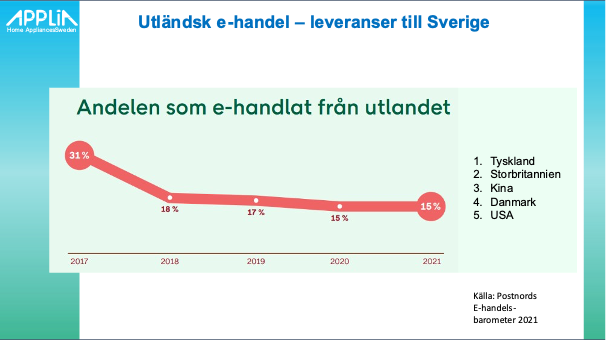

It is traded from abroad

If we go by Postnord's e-commerce barometer, which shows that a full 15% of consumers have shopped from foreign distance sellers. Mainly from Germany. But Denmark has increased considerably recently as both China and the UK have decreased sharply – mostly due to extra fees (China) and Brexit in the case of the UK.

Postnord's figure on the proportion of foreign purchases indicates that tax revenue from consumers' foreign purchases should be many times higher than the single meager percentage shown in 2021.

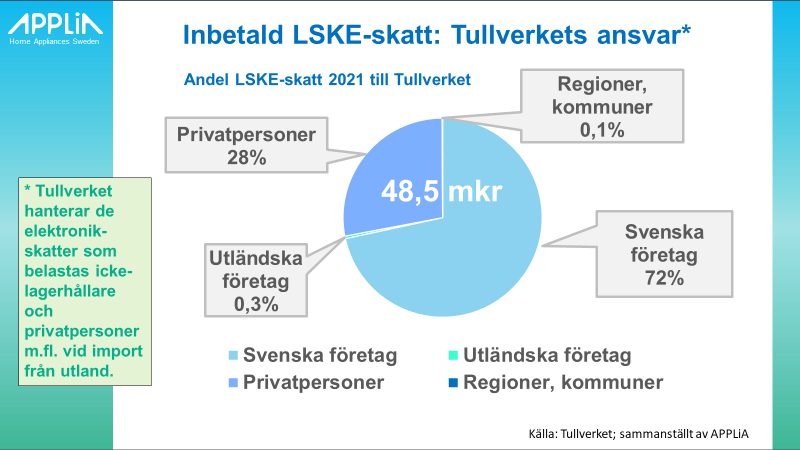

The Swedish Customs handles imports from third countries.

The Swedish Customs is responsible for tax collection according to the Swedish Customs Code for the taxes charged to non-approved warehousekeepers, such as both companies and private individuals, regions and municipalities, when importing from abroad, primarily from non-EU countries.

According to Customs data, a total of SEK 48.5 million in chemical tax has been declared to the Swedish Customs during the period 2021-01-01 – 2021-12-31. This is a very small proportion of the total tax amounts – only 3 percent of the total electronics tax revenues in 2021. Of the total electronics tax declared, a deduction of SEK 2.3 million has also been granted to the Swedish Customs.

Total to Swedish Customs: 48,505 thousand SEK

Of which:

Swedish companies, 34,737 thousand SEK

Foreign companies, 198 thousand SEK

Private individuals, 13,527 thousand SEK

Regions and municipalities, 42 thousand SEK

The percentage shares of the Swedish Customs' tax revenue from the electronics tax are shown in the diagram above.

Summary foreign e-commerce / electronics tax

The purpose of the new law on tax liability for foreign distance traders introduced in October 2020 was to:

”"”reduce distortion between Swedish and foreign actors who sell goods that are taxable under the Chemicals Tax Act directly to Swedish consumers” (quote from the Ministry of Finance's proposal, October 2019).

APPLiAnytt can now state that any "reduced distortion" has hardly been achieved! Only a meager percentage of tax revenues come from distance selling in Europe, which we know is strong primarily from Germany and Denmark for taxable products such as vacuum cleaners, robot vacuum cleaners, electric grills, microwave ovens, computers, tablets, game consoles and other home electronics.

But, just as the investigation from the Ministry of Finance concluded before the tax for EU traders was introduced, ”"It is difficult to estimate to what extent foreign operators will pay the tax from countries within the EU and what proportion of Swedish consumers will pay the chemicals tax when purchasing from third countries.".

Now we know that the Ministry of Finance was right on at least that issue – that tax collection is difficult. Foreign players have no great desire to pay this Swedish (and in their eyes incomprehensible) special taxation, which has no equivalent in the EU.

So the question remains; what does the government now intend to propose to achieve the competitive distortion between Swedish and foreign players that was promised?

Kent Oderud, Chairman of APPLiA

*In the text above, both the terms ELECTRONICS TAX and CHEMICAL TAX (in the quotes from the Ministry of Finance) appear. They refer to the same phenomenon (LSKE – Act on Tax on Chemicals in Certain Electronics). APPLiA insists on calling this tax an electronics tax, as its structure taxes selected goods containing electronics according to their total product weight – not specific chemical content. A washing machine with heavy counterweights, shock absorbers, electric motors, recyclable sheet metal, etc. that weighs 70-90 kg generates more tax than a PC weighing 2 kg, even though the electronics content in both is fairly extensive.