2022.04.27

Total market 2021 in consumer value and number

APPLiAnytt can now present the final market figures in both value and volume for the total market for white goods and household appliances in 2021 in Sweden.

The figures are based on APPLiA's industry statistics supplemented with adjustments for, among other things, the statistics' coverage level and show the Swedish market's total volumes and the industry value at the consumer level including VAT and other taxes.

25 billion in consumer value

The white goods and household appliances industry had a total consumer value of SEK 25.1 billion in 2021 in Sweden. The figure is an estimated value from the supplier figures in APPLiA's statistics, which takes into account market coverage per product segment, different distribution channels, estimated trade margins, VAT and other taxes/fees such as the electronics tax.

Value growth in 2021 was plus 8 percent and was driven primarily by larger household appliances, i.e. white goods (MDA in industry parlance). These now account for SEK 16.4 billion in consumer value out of the total SEK 25 billion. For smaller household appliances, we have calculated a consumer value of SEK 8.7 billion.

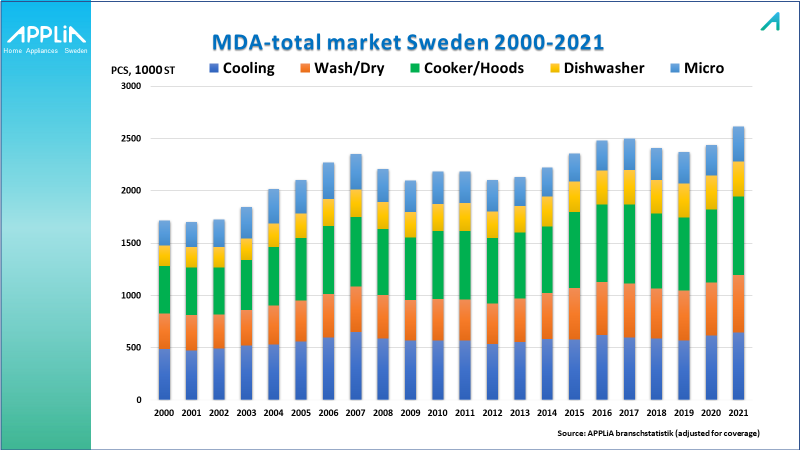

Volume growth for white goods

If we look instead at the number of appliances sold (MDA) in Sweden, we have exceeded 2.6 million units for the first time. Volume growth in 2021 was just over 7 percent for appliances in total.

The largest contribution to this increase is seen in the product segment cooker/oven/hob/fan. This segment is also the area that has shown the greatest long-term growth over the years, as can be seen in the diagram above. One explanation is that the segment with built-in oven and hob has increased its share compared to free-standing cookers. In new construction, for example, built-in products (oven+hob) are completely dominant over free-standing cookers.

Next in the long-term growth league is the washer/dryer segment. Here, the increasing privatization of doing laundry in one's own home versus using shared laundry rooms contributes to long-term growth. This growth was especially visible during the pandemic years when more consumers sought high-performance washing machines with functioning disinfecting wash programs.

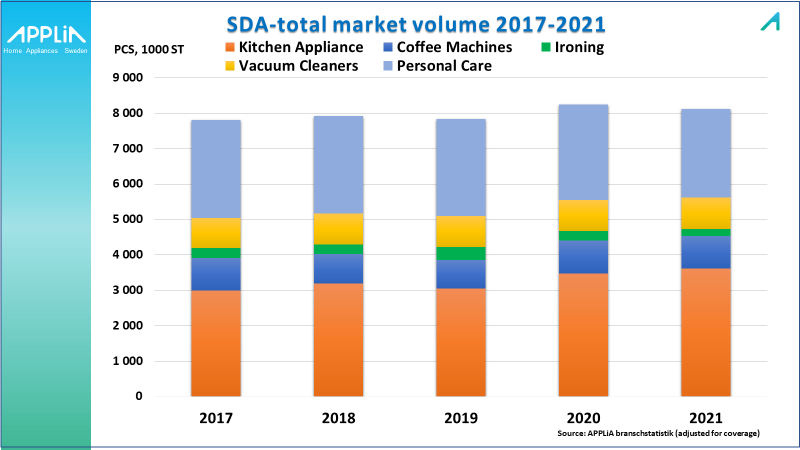

Volume stable for household appliances

After a record year in 2020 and a very good start in 2021 for small household appliances (SDA), the market slowed down in terms of volume development in the last quarter of 2021. This resulted in a decline in the total volume for SDA for the full year of minus 1.5 percent. 2021 will still be one of two years where the volume exceeds 8 million units in Sweden.

Even compared to the period before the pandemic, the annual volumes for 2021 are significantly positive. Volume growth compared to 2019 is more than 280,000 units.

Within the main group Kitchen Appliances, the group of products that is increasing the most within SDA, "toasters & grills" which include air fryers, toasters, waffle irons and sandwich irons, as well as "kitchen machines" which include kitchen machines and food processors, account for the largest positive volume growth.

The ”mixers and blenders” segment with hand whisks, hand mixers and stand mixers also contributes positively to the volume development within this main group. The opposite applies to the ”ironing” segments, which continue to decline for the third year in a row, and coffee machines, which lost volume in the latter part of 2021.

More high-quality products

However, the volume slowdown for SDA products in 2021 is offset in value terms by the fact that more expensive, higher-performance devices were sold on the market, which resulted in higher average prices. This is clearly evident in the product categories coffee machines, kitchen appliances/assistants and dental products, which increase the value of what is allocated to the market.

Kent Oderud, Chairman APPLiA