2023.02.07

The industry year 2022 ended in a low

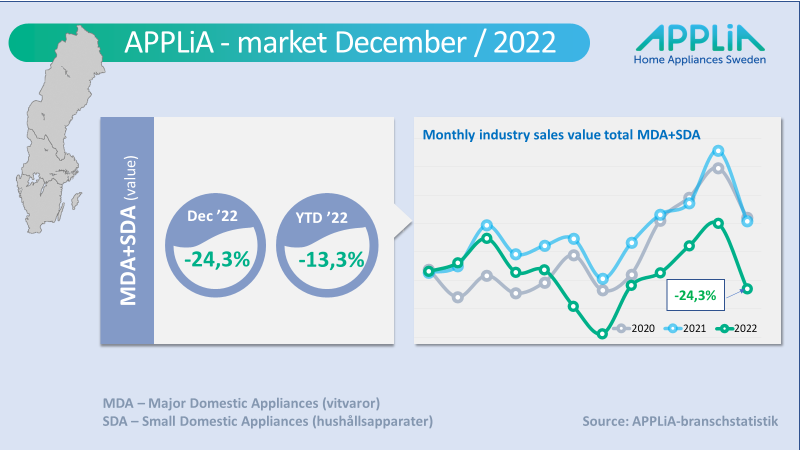

The year 2022 ended with a December that played in minor tones when it comes to market developments for white goods and household appliances. With just over minus 24 percent in the month of December, the accumulated annual result was reduced compared to the previous year to minus 13.3 percent. This is a significantly worse development compared to the development during the two record-breaking pandemic years of 2021 and 2020.

… but positive compared to comparable year 2019

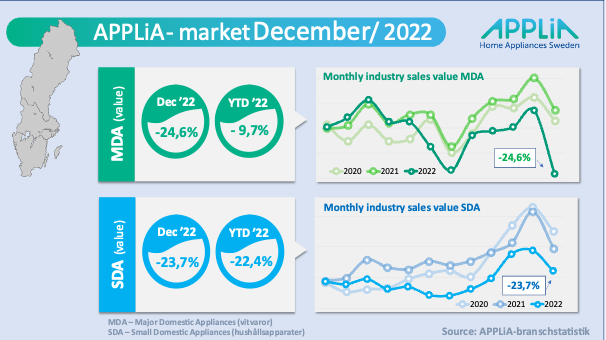

If we compare the market value with the year 2019, before the pandemic, the end of 2022 still means 3 percent better for the entire industry in comparison. It is mainly MDA (white goods) that increases compared to 2019 by plus 4 percent. Household appliances (SDA) sold as well as in 2019, i.e. they show plus/minus 0 percent compared to the normal year.

Downhill after the first four months

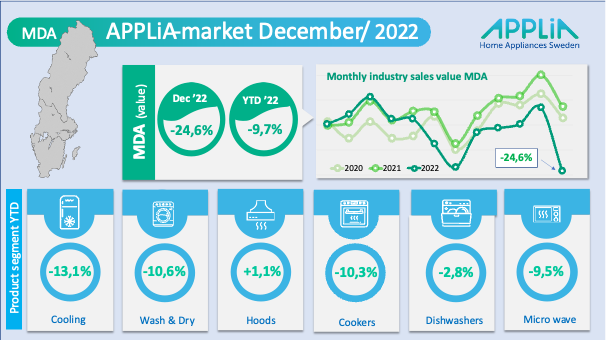

For white goods (MDA), the year started with a positive first four months, but since then the figures have not reached last year's level. The uncertainties that erupted in the world situation after this point then caused the market to slow down significantly during the latter part of the year and ended the year's 12 months with a value loss of minus 9.7 percent.

After the two record years during the pandemic years of 2020 and 2021, small household appliances (SDA) had a tough time coming close to these values. They now show a decrease of 22.4 percent for the full year 2022 compared to the previous year.

Kitchen hoods performed best in sales

The heavy product segments of refrigeration products, washer/dryers and cookers among white goods all recorded a loss compared to the previous year. A few individual subcategories, such as built-in refrigerators and freezers and built-in ovens, increased compared to 2022. Kitchen hoods fared the best, with the entire segment increasing by just over 1 percent over the previous year. The delay in completing the extensive kitchen renovations that began during the pandemic explains the positive figures for these product categories.

The record years for SDA are hard to beat

The record year increases for SDA of 23 percent (2020) and a further 8 percent (2021) were exceptional and could be attributed to the increased stay-at-home and working-from-home during the pandemic, when both new coffee machines and new kitchen appliances/assistants were sold on a large scale. In 2022, all SDA segments (see above) show negative figures compared to 2021. With the return to 'normal' after the pandemic, sales of household appliances have also returned to a normal level and are on par with the normal year 2019 - before the pandemic, inflation, electricity prices, economic downturn and uncertainty in the world situation.

Nevertheless, there are some subcategories of goods that are positive compared to 2021; for example, kettles increase their market value by almost 3 percent. The consumer's desire to save a few more kilowatts when boiling the water for tea probably affects this. The categories hair care (for example, hair dryers) and electric toothbrushes, both of which are part of the 'personal care' segment, also increase their market value by a few percentage points in 2022, while other product categories decline.

We keep the style…

So even though the clouds have been dark and the market music has been playing in a minor key, the industry has still contributed to many in Sweden having both stylish hair and shiny white teeth to face 2023 with.

//Kent Oderud