2023.08.29

Do the industry's half-year figures indicate a turnaround?

Do June's positive industry figures possibly indicate that the industry is on the way to turning up again? A strong value result (+15.8%) in the month significantly improves the industry's accumulated results for the first half of the year. In fact, June 2023 is the first month where the industry's total turnover beats the corresponding month in the previous year.

There are trends towards a turnaround, but we are not yet out of the slump after the pandemic – even if inflation is contributing in terms of value. The industry's volume development remains negative for most product segments and figures from Statistics Sweden in June show that  Swedish households' total consumption decreased by 0.1 percent in June compared to May 2023. Compared to June 2022, consumption decreased by 1.7 percent, measured in calendar-adjusted figures and constant prices.

Swedish households' total consumption decreased by 0.1 percent in June compared to May 2023. Compared to June 2022, consumption decreased by 1.7 percent, measured in calendar-adjusted figures and constant prices.

Economic forecast bleak

The National Institute of Economic Research's economic update presented on August 9 indicates continued economic gloom and speaks of continued high inflation and increased interest rates, which have hit interest-sensitive Swedish households hard and housing construction in the country. This construction is now declining rapidly. Together with a slowdown in exports, the National Institute of Economic Research predicts that Sweden's gross domestic product (GDP) will decline by almost 1 percent this year.

The National Institute of Economic Research also notes that the recession has not yet had an impact on the labor market, but the number of employed people will decrease in the coming quarters and unemployment will increase to 8.4 percent next year. Inflation continues to decline in the long term and in the second half of 2024 it will be clearly below the Riksbank's inflation target. The Riksbank will therefore initiate a series of interest rate cuts towards the summer of next year, according to the country's experts, which will also affect our industry.

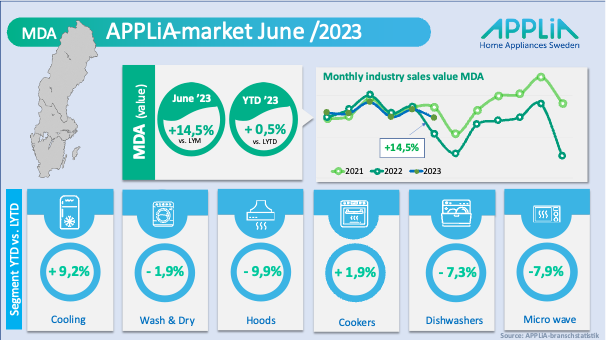

The MDA value is a source of joy

For our industry, the half-year figures for major appliances (MDA) are now at a pleasing plus (+0.5%) compared to the previous year. This is thanks to a good development in value terms for MDA during the month of June with +14.5 percent over June 2022.

During the first six months of the year, the product segment ”cooling” (refrigerators, freezers, boxes, wine cabinets, etc.) showed the most positive development in terms of value, with just over 9 percent. If we compare this value with the volume development in numbers, the numbers in this segment decrease by just over 5 percent. The same applies to the other product segments, for example ”cookers” (stoves, ovens, hobs), which decrease in volume by 7 percent – compare with the value development above (+1.9%).

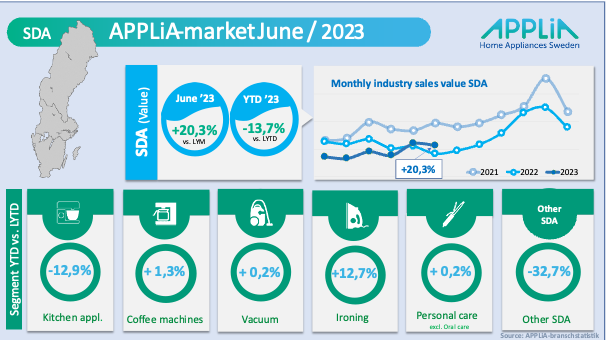

Encouraging figures also for SDA

For small household appliances (SDA), the month of June meant a real boost with an increase of a whopping 20.3 percent compared to June last year. Both May and June have now increased compared to the previous year and thus add somewhat to the half-year result, which is still in the red (-13.7%).

The ironing products segment showed the best development in terms of value and volume, with +12.7 percent in value and just over +10 percent in number. The coffee machine product group also saw a value increase (+1.3%), but here the number fell by almost 10 percent.

Will the state budget boost Sweden?

An uncertain and windy autumn awaits us, where crisis headlines will likely continue to replace one another. Therefore, it is now important to bite the bullet and wait to see what the government's autumn budget focuses on, among other things. The National Institute of Economic Research forecasts that the state budget for 2024 is expected to contain unfunded measures equivalent to SEK 45 billion, of which SEK 25 billion is directed at households. Perhaps this will give the economy a boost.

Text: Kent Oderud