2023.12.18

October: a month with weak positive trends

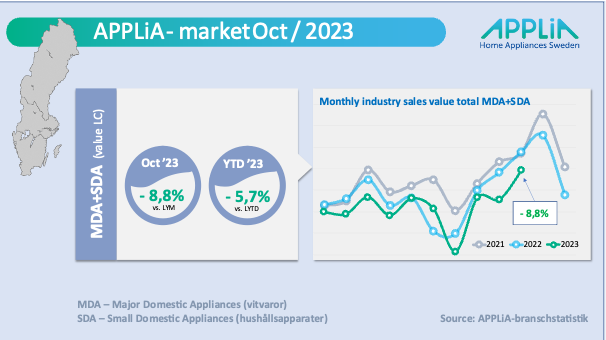

Despite weak positive trends, October still does not match last year's figures in the white goods and household appliances industry. Overall, for all industry segments, the value of sell-in to the retail level is 8.8 percent below October's outcome last year.

Weak positive trends lead to weak annual forecast

Weak positive trends lead to weak annual forecast

If we look at the month with our positive glasses, we note that October is still the month with the strongest turnover so far in all of 2023. However, in terms of value, companies in the industry are now 5.7 percent below the corresponding period last year after the first ten months of the year. The forecast for the end of 2023 looks set to land on a decline of around 6 to 7 percent in terms of value, APPLiA estimates.

HUI sees a positive future

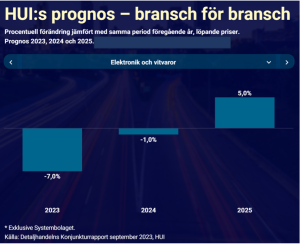

This is quite consistent with HUI's 2023 forecast for electronics and appliances in retail (-7.0%), shown above. HUI then shows a forecast picture that suggests a turnaround next year, then landing on a five percent increase in 2025.

SDA loses

Household appliances (SDA) had a very tough first quarter and have since had a few better months of "even beard" with 2022. In October, the month lands at a 14.2 percent lower level (in value terms) than the same month last year. This despite the fact that October this year was the month with the highest turnover in all of 2023.

The "ironing" category continues to be the only category showing positive volume development in the SDA segment. Textile steamers and other ironing equipment seem to be going home as Christmas gifts this year as well.

MDA shows some cautious recovery

White goods (MDA) are also down compared to October 2022, but are recovering compared to the large drop in September. The month's minus of 5.7 percent gives an accumulated outcome of minus 4.6 percent after the first ten months of the year.

The category within MDA that has been least affected by the decline is ”cookers”, which includes stoves/ovens/hobs. This category is still around 8 percent behind last year in terms of volume.

Text: Kent Oderud