2024.02.07

A weak end to 2023

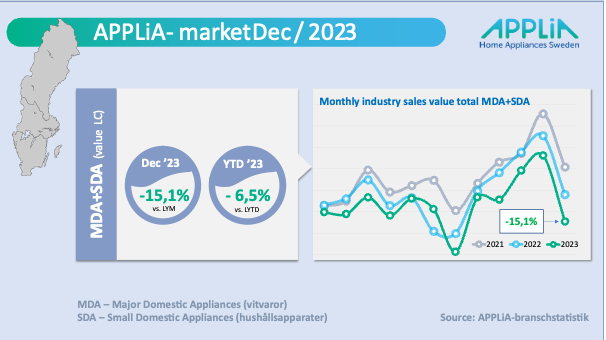

December of this year ended weakly for the industry as a whole, but with a cumulative decrease of 6.5 percent compared to the previous year, the figures for "sell-in" still ended slightly better than our annual forecast.

December is traditionally one of the weaker months of the year – partly because sales to retailers for Christmas are already made in November, and partly because the month has many holidays with time off among our industry companies. Against this background and generally cool demand, the value result for the month was a loss of just over 15 percent compared to December last year.

Household appliances lost the most in December

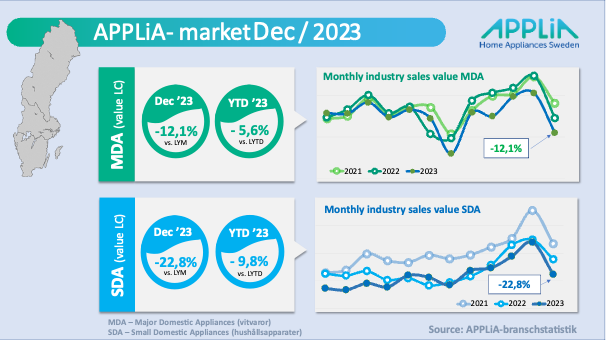

Compared to December 2022, the small household appliances (SDA) product segment lost the most, at minus just over 22 percent. This also applies to major appliances (MDA) to some extent, although its decline was limited to just over minus 12 percent in the month.

Over the full year, MDA had a fairly strong first half of the year, while the rest of the year fluctuated significantly. The full year ended with a 5.6 percent decline in value.

For smaller household appliances, the corresponding annual figure is a decline of 9.8 percent after having a very difficult start to the year and a weak end in December.

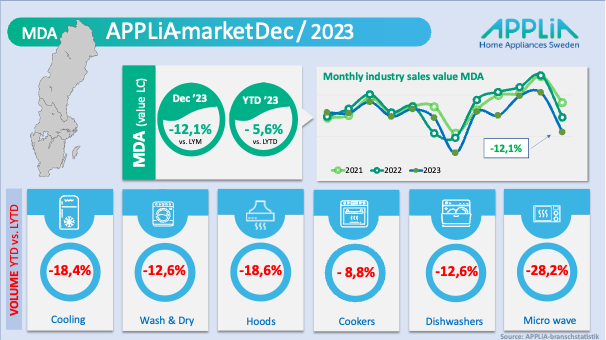

Decline for all MDA product segments

When it comes to the volume development of the industry's white goods in 2023, we can see that we are consistently showing red numbers. The number of units sold is decreasing during the year, both in terms of deliveries to retailers and due to the shrinking housing production in Sweden.

As a curiosity, we can mention a small exception to this declining trend. The combined washer/dryer machines, which belong to the ”wash & dry” segment, are the only category within MDA that can show a positive volume development during the year with 45,000 units sold, which is 8 percent better than in 2022.

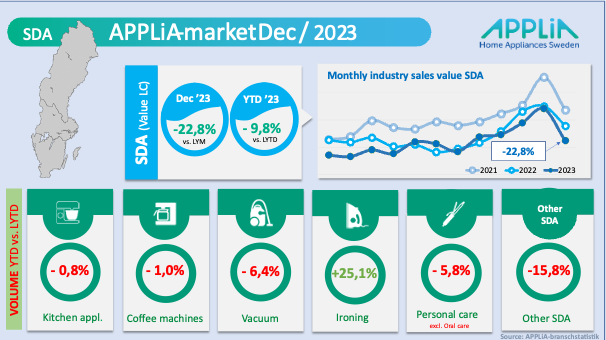

Softer volume decline for SDA

For smaller household appliances, the volume development in 2023 is somewhat less striking than for larger white goods. There are even more subcategories of products with positive development in units sold. Some of these are kitchen appliances/assistants, mixers, ironing equipment and electric hair care products.

What will 2024 be like?

If we lean towards HUI's forecast for 2024 for white goods and home electronics, consumer sales are predicted to stabilize around minus 1 percent and then show stronger growth in 2025 of 5 percent. In addition, we should take into account decreasing white goods deliveries to the construction sector in 2024. How they then affect the outcome in 2025 depends on the Swedish interest rate situation and on how the market for newly produced housing may recover. We are following the development.

Text: Kent Oderud, chairman of APPLiA