2024.05.14

Quarterly Report 1, 2024: A dismal first quarter

At the recently held annual meeting of the industry organization APPLiA, some meeting participants were heard to say that the first quarter of the year for white goods and household appliances was 'dismal' when the market development for the first quarter was presented.

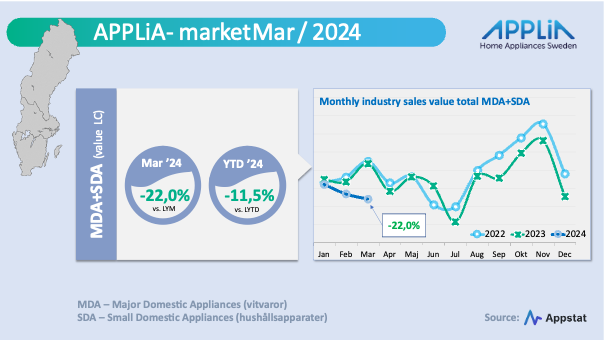

That statement is understandable. The market development in the month of March crushed all hopes of a decent first quarter. The industry's overall figures (MDA+SDA) for the month of March with minus 22 percent in value terms are not cheerful reading. March of this year thus did not even come close to the corresponding month of the previous year, as can be seen in the diagram above. Accumulated, the industry's sell-in value is now 11.5 percent lower than the first quarter of the previous year.

MDA has the toughest time

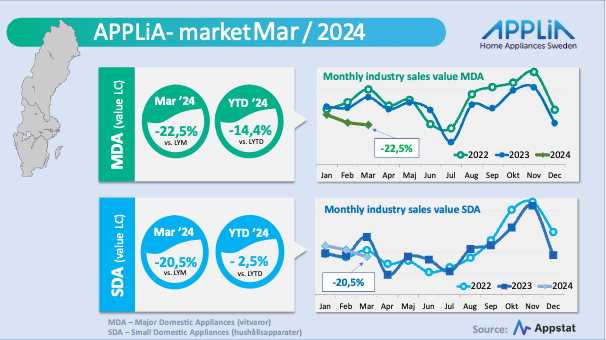

After the first three months of the year, it is the major appliances (MDA) that have fallen the most in value terms, with an accumulated 14.4 percent compared to the comparison quarter in 2023. Low general consumption in the country of durable goods, high interest rates and a slowdown in new housing production are behind the decline.

The low level of consumer readiness can also be largely explained by an increase in the tax levy for the so-called electronics tax that took place on white goods and home electronics in 2023 and now burdens a regular dishwasher and/or washing machine with almost 700 kronor in extra special taxation. This increase in price naturally slows down the power of demand and drives many consumers to purchase via other non-taxed channels, which are outside APPLiA's statistical base.

For small household appliances (SDA), the picture is not as bleak – there is no additional electronics tax for most product categories. Only vacuum cleaners are the group of SDA products that are subject to electronics tax. After starting the year quite strongly, the SDA segment is now 2.5 percent behind last year.

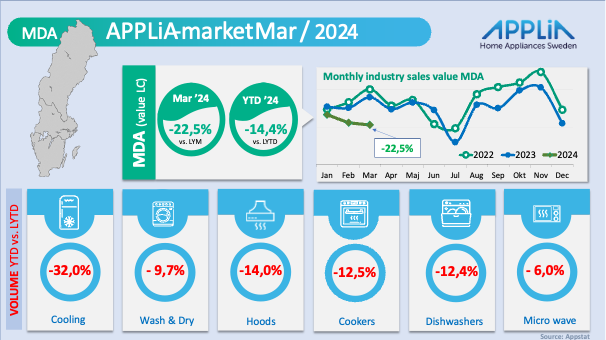

MDA – straight red numbers

The segment report above shows the volume development for the various MDA segments up to and including the first quarter of this year compared to the same period last year. It shows consistently red figures for all MDA groups – the microwave ovens and washer/dryer segments are doing the least well with minus 6 percent and 9.7 percent respectively. The worst start to 2024 has been for refrigerators and freezers.

SDA – doing better

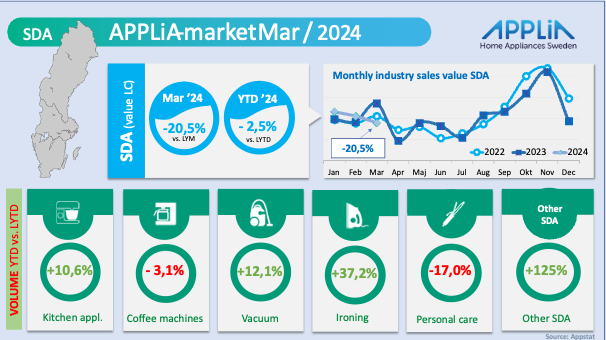

Despite a weak March, there are several segments for SDA products that have developed positively in terms of volume compared to the previous year during the first quarter. Within "Kitchen appliances", it is coking machines/assistants and food processors that stand out positively together with "mixers & juicers". On the vacuum cleaner side, there are two categories that account for the majority of the increase; traditional floor vacuum cleaners with bags and the newer rechargeable stick vacuum cleaners.

For the iron category, it is steam irons that have regained strength, after the decline during the pandemic, as well as "steamers" that are driving the large volume increase for this product category.

Outlook for next quarter

Some of the darkest clouds for the future were lifted when the Riksbank began its expected series of interest rate cuts last week. The mere fact that inflation has begun to calm down and that we have now reached the interest rate peak is causing some corners of the mouth in many industries to move upwards. But expecting any major positive effect in the coming quarter for the APPLiA industry is not possible.

But there is hope. The Visma Business Barometer* survey of retail companies, for example, shows a budding optimism among them. According to Visma, 43 percent of retail companies believe that their sales will increase over the next six months, which is in line with the average for all industries.

And the study adds an important encouraging message to both small and large companies in the retail sector: "A recession is always shorter than a boom.".

*Visma's Business Barometer is based on a survey completed by 1,002 small and medium-sized companies between March 12 and April 15, 2024.