2025.05.26

April: Worst industry month in a long time

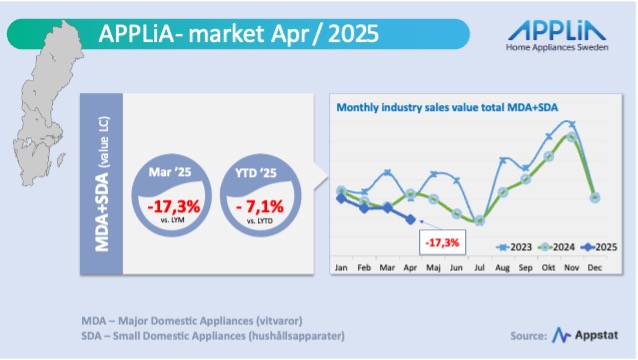

The budding signs that the APPLiA market is recovering, which have been visible in recent months, suffered a real setback in April. In terms of value, the sell-in value for April landed down by a full 17 percent compared to the same month in 2024, and the value for the entire four-month period thus dropped to minus 7 percent.

A really weak month in Sweden

We have to go back a long way in time in the Swedish market statistics to find a worse monthly comparison for the industry than the one that the month of April shows. Is it the sharply reduced housing production of both multi-family buildings and single-family houses that is making a difference? Or is it an effect of the reduced consumption space among the inhabitants of Sweden? Have prices increased so much due to the drastically increased tax collection of the heavily criticized electronics tax, that it gives consumers more reason to compare prices and shop from foreign trade, which is only a "click" away?

Postnord's latest report on the development of e-commerce points to a sharp increase in imports from other countries - at the top are of course China and Germany, but Denmark is also among the top five, according to Postnord.

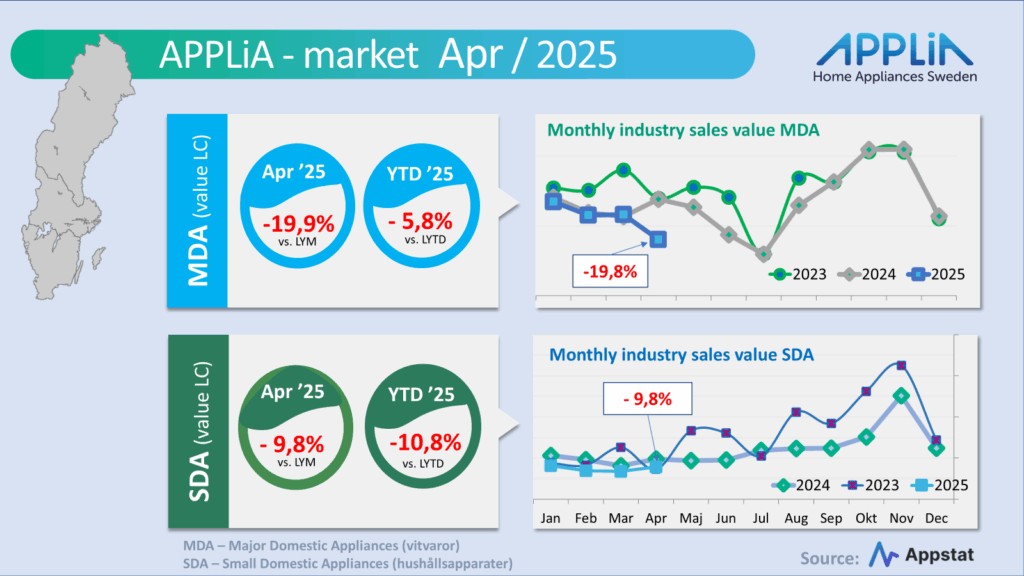

White goods (MDA) – a tough uphill battle

An extra look at the APPstat figures was needed to understand the tough April report. The sell-in value for April is down almost 20 percent – accumulated (=YTD) so white goods now also lost touch with the zero stretch (-5.8 %). In terms of volume, for MDA collected in April, the figure landed at minus 15 percent – see each product area in the next image.

Household appliances (SDA) – in the same uphill slope

Smaller household appliances did not have as dark a month (April) as larger appliances, and have now this year positioned themselves at a steady level around the minus 10 percent mark compared to 2024.

For these product groups, the turnaround from a dark to a brighter economic outlook rests heavily on a general increase in consumption. Scattered ”small rockets” have already burned down, but the larger shopping fireworks will only start if the uncertainty in the private economy disappears and optimism can begin to sprout.

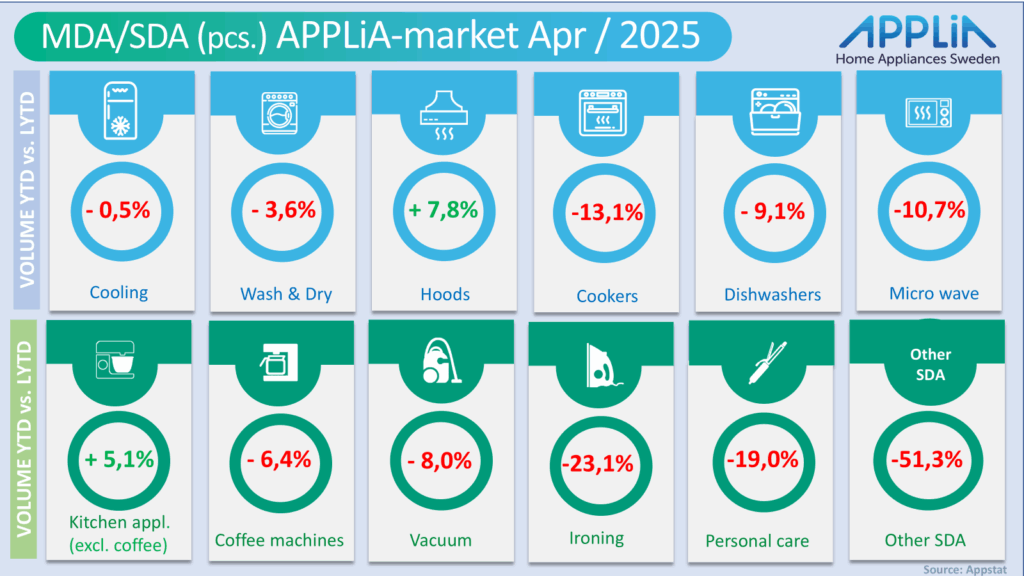

No more ”small rockets” that increase volume

Among the product segments, only range hoods and kitchen appliances are taking off like rockets with positive volume development so far this year (see summary above). Otherwise, most other product segments are in a slump.

We have to look for a while in the subgroups within each segment to find some areas with a positive volume development. One example is top-loading washing machines that are included in ”wash & dry”. These have relatively small volumes compared to front-loading ones, but they have a lower average price and are therefore an alternative for households when the economy is tight. This may explain the positive development of this product area this year – both in value and volume.

Another ”rocket” among small appliances is the waffle iron, which is included in the ”Kitchen appliances” category. This relatively small group has increased its volume by over 50 percent so far this year. It seems that waffle day did not go completely unnoticed this year!