2023.11.22

A dark September

The deepening recession and the sharply increased electronics tax at the turn of the year led to a significant decline in sales of white goods for the important autumn season. For smaller household appliances, the situation ahead of autumn sales looks somewhat less negative. All according to APPLiA's September figures.

The perfect storm

The increased interest rates, the weak Swedish krona The slowdown in housing construction, inventory adjustments within retailers, consumer restraint and inflationary prices due to the heavy electronics tax – all these factors are now having an impact on the market. In September, this means an outcome for the entire industry that is just over 13 percent below the outcome for the same month in 2022. Cumulatively, the three quarters of this year are 5.2 percent (in value terms) below the first three quarters of last year.

The slowdown in housing construction, inventory adjustments within retailers, consumer restraint and inflationary prices due to the heavy electronics tax – all these factors are now having an impact on the market. In September, this means an outcome for the entire industry that is just over 13 percent below the outcome for the same month in 2022. Cumulatively, the three quarters of this year are 5.2 percent (in value terms) below the first three quarters of last year.

Household appliances better in September than white goods

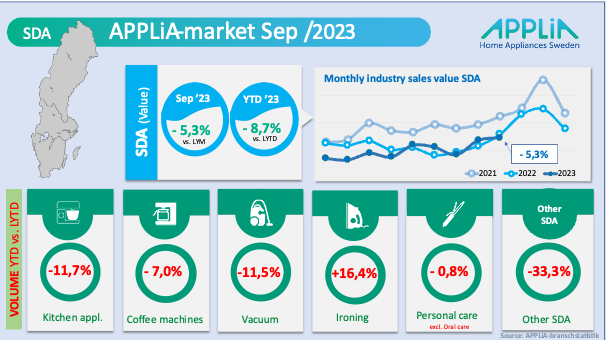

Despite the very weak development in the first quarter, household appliances (SDA) landed on a September result in terms of value of minus 5.3 percent and have now in recent months begun to approach the outcome during the corresponding period last year. This while white goods (MDA) went on a real decline during September. The comparison with September 2022 landed on minus 16 percent for MDA. A bad white goods month to say the least that affected the accumulated outcome down to  minus 4.2 percent after the past three quarters of the year.

minus 4.2 percent after the past three quarters of the year.

Volumes (MDA) are declining sharply

At the end of each quarter, APPLiAnytt also usually presents the development broken down by product segment. This time we show this in volume. This way you get a more complete picture of how the market has developed. Reporting on volume gives a picture unaffected by inflation.

The report above shows that all MDA product segments have suffered double-digit percentage declines during the first three quarters of the year compared to 2022. The segments that have performed "least poorly" are stove/oven/hob and refrigeration products. The volumes for these are kept relatively high by ongoing deliveries to housing production, but have a negative forecast going forward as the reduction in housing and single-family home construction also has an effect on white goods deliveries to these sectors.

Ironing products are the only ones that don't take a beating

This time we are also reporting the volume development per product segment for SDA products. Among these, there is a winning segment – ironing products (irons, steam stations, steamers, etc.) – which is increasing by just over 16 percent compared to 2022. However, we should remember that this development is happening from a very low level where the ”ironing” segment has declined significantly over the past three years during the pandemic. Now things are turning around and shirts and blouses are being ironed again in Sweden.

The ”Personal care” segment no longer includes the electric toothbrush category, as a major supplier has opted out of the statistics. The category now consists of hair care and hair removal devices, and with the volume only down 0.8 percent, and thus almost unchanged from the previous year, it feels as if consumers are placing importance on a well-groomed appearance, despite the dark economic clouds in the sky.

Text: Kent Oderud