2024.05.31

Sales statistics April: A sign of a turnaround?

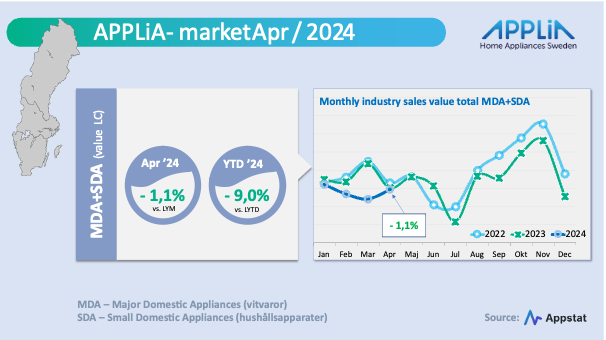

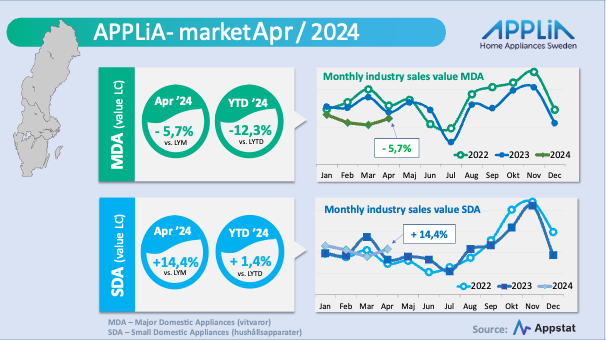

The smaller household appliances show a turnaround in market development, while the heavier white goods are still struggling after four months with negative figures compared to the same period last year, according to APPstat's latest market figures.

April still a sign of recovery

The month of April gave some oxygen to the market development for sell-in of household appliances in Sweden. Seen in light of the economic reports that have been published recently, white goods/household appliances are following "the flow" of how the market for consumer durables is developing.

Continued recession – but hope for a turnaround

Statistics Sweden's latest economic watch now shows indications that the recession in Sweden continues. In March, ten out of thirteen indicators were below their long-term trend. Households stand out in both directions. The indicators for household consumption and retail trade in durable goods are still in the recession phase, while the household confidence indicator, which partly consists of future assessments, is in the expansion phase. These forward-looking indicators really show great optimism about an upturn in the future. This is stated in Statistics Sweden's magazine The Economy of Sweden – Statistical Perspective.

Household appliances (SDA) the heroes of the quarter

After a very weak month of March, April (with slightly more working days) turned out significantly more favorably for smaller household appliances in particular, which beat April 2023 by just over 14 percent in value terms. The volume increase was 13 percent, indicating that the increase in value is not entirely due to price developments for these product categories.

The increase during the month of April occurs in almost all product segments within SDA – it is really only coffee machines that lag behind by a few percentage points.

White goods (MDA) continue to struggle against headwinds

Despite a certain sobering up for the MDA segments washer/dryer and range hoods in the month of April, the other product segments are dragging down the figures so that the month ended almost 6 percent below the same month last year. Above all, it is the product groups within "cooling" that are really lagging behind last year. Here we see quite substantial volume losses of more than 20 percent for many of the product categories within this segment, e.g. freestanding refrigerators and freezers.