2022.02.23

Keep up with industry trends – part 2

In the last newsletter, we covered the product trends surrounding the industry. household appliances (SDA). APPLiAnytt continues our series where we present some of the industry's most important product trends and now we have reached MDA (major appliances), where this time we focus on the segments Washing & Drying, Refrigeration Products, Dishwashers and Integrated Appliances.

If you follow APPLiAnytt, you will be able to take advantage of the trends for other white goods in 2021 in upcoming newsletters.

Washer/dryer combos continue to grow

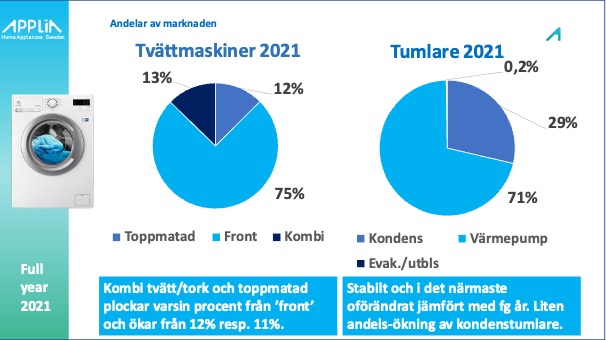

The trend we saw already in 2020 with 'pandemic' increases in space-saving washing machines, such as COMBINED WASHER/DRYERS and TOP-LOADED, continued in 2021, with both categories nibbling away at the dominant position of front-loading machines in the market by a few percent. Many people certainly wanted to supplement their household laundry with a household washing machine in the apartment during the worst of the pandemic to avoid crowding in the shared laundry room. As a result, these space-saving machines increased their share of sales.

For Tumble Dryers, sales of heat pump tumble dryers continue to dominate, but in 2021 the rate of increase for these stopped and a smaller increase in traditional condenser tumble dryers can instead be observed. Sales of evacuation tumble dryers (exhaust…) are now very insignificant.

High spin / large capacity

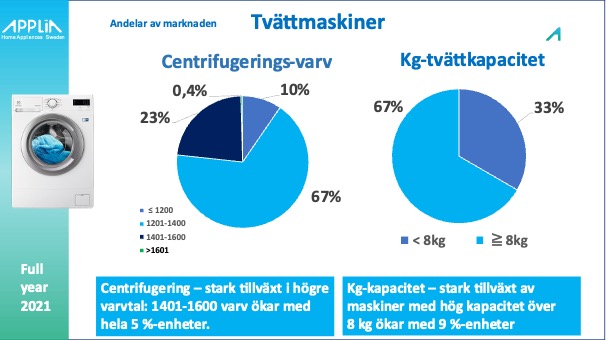

Two performance trends stand out clearly in 2021 among front-loading washing machines:

- Strong growth among washing machines with higher spin capacity above 1400 rpm, which makes the laundry drier before drying and is thus more energy efficient.

- Washing machines with a washing capacity of over 8 kg of dry laundry are racing towards complete dominance over all front-loading washing machines, increasing by a full 9 percentage points during the year. Customer pressure for machines with a high kilo capacity is therefore increasing – perfect for larger weekly washes!

A clear trend is also highlighted by our store contacts that washing machines with automatic detergent dosing are increasing the sales share in stores during the year. Unfortunately, we do not yet have concrete figures on this, but the store data on this is unambiguous.

Freezers – this year's cool bubbler

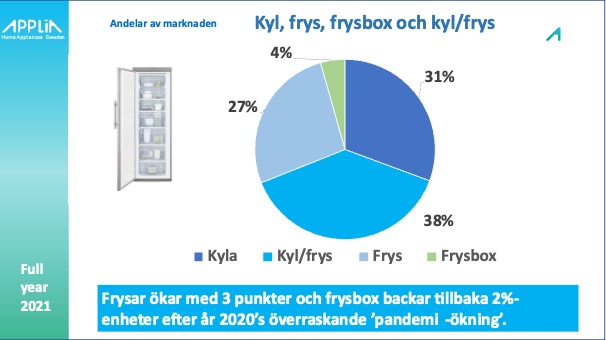

In the refrigeration segment, we are back to a pre-pandemic situation, where the surprisingly high demand for chest freezers, which occurred during the early pandemic period, has now slowed down. And thus, chest freezers have regained the share that was 'lost' to chest freezers in 2020. The largest contribution to the increase comes from integrated cabinets – see more about this further down in the article.

Otherwise, the shares within the segment have been relatively stable between product categories over the past year.

Slim dishwashers are on the rise

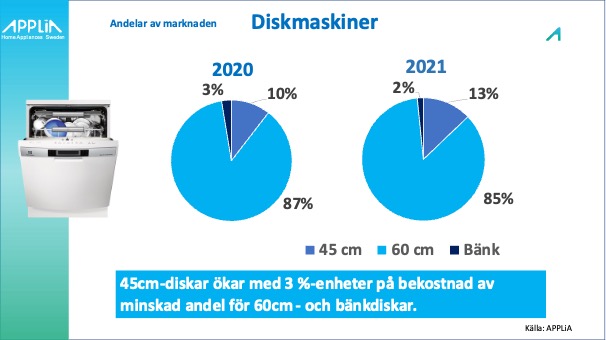

The larger 60 cm counters continue to dominate the market in terms of numbers with an 85 percent share, but it is the narrower 45 cm counters that are increasing significantly during the year (+3 percentage points). The 2020 increase in countertop counters is seen as a pandemic effect and is now back to a 2 percent share.

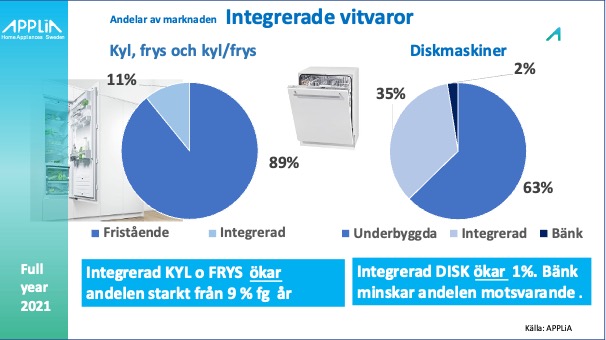

The increase in 45 cm countertops is driven by the increase in the integrated models that the market offers. So let's look at how the INTEGRATED appliances stand in terms of share in Sweden in the next picture:

Integrated appliances flex their muscles

Among all DISHWASHERS, the integrated models with wood-paneled fronts have already established themselves firmly. But the category is still growing by one percent in 2021 (mainly thanks to the increased sales of integrated 45 cm dishwashers) and now accounts for a full 35 percent of the market!

For integrated REFRIGERATORS and FREEZERS, Sweden does not have quite the same momentum towards integrated solutions as we see in our Scandinavian neighbors and on the continent. For many years, the share has been between 5 and 9 percent. In 2021, this particular category takes the step over the threshold and rakes in an increase of 2 percentage points to a market share of 11 percent.

Stay tuned for the next APPLiAnytt

In the next newsletter, we will continue our trend scouting among our industry products in 2021 – then we will provide insights into the development of the products that are central to all our kitchens – stoves, ovens, hobs and extractor fans. Stay tuned!

Kent Oderud, Chairman of APPLiA

Photo: Unsplash