2025.02.10

Market development for the full year 2024 – the clearest trends for white goods and household appliances

The last quarter of 2024 indicates that a turnaround is underway in the white goods market. Or at least a long-awaited stabilization of market development. This is now shown by APPLiA's review of 2024 industry statistics, which also points to some clear trends in this market.

Are the industry figures for the full year 2024 surprising?

The vast majority of home and construction-heavy industries generally did very well during the pandemic and many households were well invested when inflation hit. This also applies to a very large extent to white goods and household appliances. The fact that sales have since developed weakly is due to the deterioration of the economic scope for consumption. In such a situation, it is perhaps easier to hold on to money and prioritize other things than buying a new washing machine or renovating the kitchen.

It is precisely capital-intensive consumer durables that have been hit the hardest as trade has been pressured by cost increases, higher interest rates and rents, and increased tariff costs. The sharply increased tax levy for the electronics tax from 1 July 2023 has also led to higher consumer prices for goods for all trade in white goods and home electronics.

In addition, new housing production has fallen sharply in recent years, which is affecting sales figures for the industry.

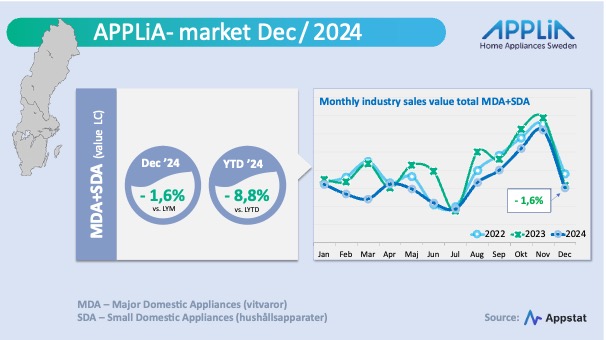

So with that changing world, it's not that surprising that the industry ends 2024 with an overall value result that is 8.8 percent below 2023.

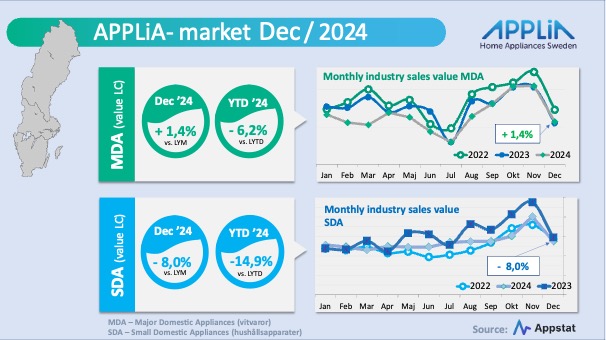

The development becomes interesting when we divide the total market figure and compare the major appliances (MDA) with the domestic appliances (SDA):

Volumes decrease and increase!

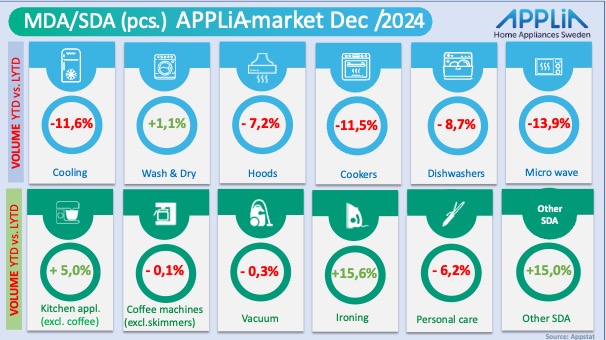

MDA declines in value during the full year by 6.2 percent compared to 2023 and is then doing slightly better than its sibling products within SDA, which show a loss in value of 14.9 percent compared to last year. If we instead compare the volume development, we can see that MDA has a percentage decline of 8.3%. The corresponding volume development for SDA ends up at plus 4.6 percent. In summary, SDA has reduced its average prices significantly during the year. The opposite applies to white goods.

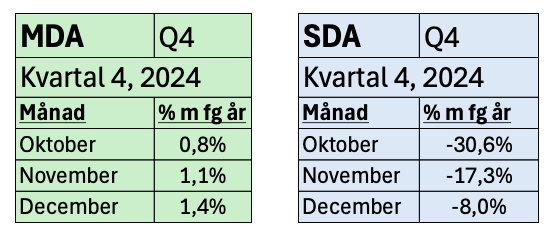

Fourth quarter 2024 shows improvement

The industry figures at the end of the year in the 4th quarter give hope for improvement. For MDA, the last three months of the year have even shown a positive trend with three consecutive positive months.

For SDA, the distance to 2023 will decrease noticeably in the fourth quarter of 2024 and the negative numbers will become somewhat more digestible.

Some of the 2024 trends among product categories:

Stoves – induction continues to grow

For the product segment "cookers", the volume will decline by 11.5 percent in 2024 compared to 2023. This is a reflection of the slowing pace of new construction in Sweden, as the decline is hitting built-in products (ovens, hobs) particularly hard.

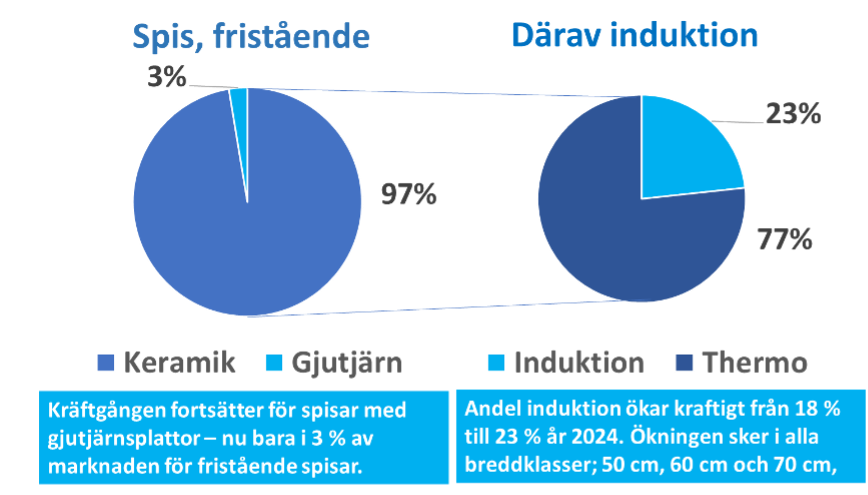

The most prominent trend in this product segment is the increasing share of induction technology among freestanding ceramic hobs vs. those with traditional thermo-zones:

For built-in hobs, which are also included in the "cookers" product segment, this dominance of induction technology has been present for several years, with shares exceeding 85 percent of all ceramic hobs sold in Sweden.

Washing machines and dryers – energy efficiency

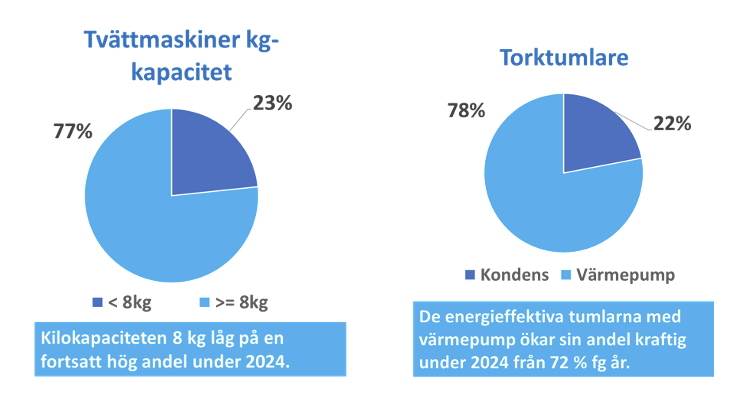

The "wash & dry" segment has had a positive volume development over the past year (+1.1%). The volume increases come mostly from top-loading washing machines, larger washing machines over 8 kg with spin speeds of 1200-1400 rpm, and from dryers with heat exchangers.

The trends that have emerged in 2024 are the continued large share of washing machines with a capacity of 8 kg of dry laundry and above. For dryers, growth for dryers with energy-efficient heat exchangers remains strong and the share is increasing to 78 percent in 2024.

Kitchen appliances / kitchen assistants / food processors

The entire ”Kitchen appliances” segment increased by 5 percent during the reporting year. It is primarily the ”mixers & juicers” categories, which also include blenders, hand mixers, electric whisks and toasters as well as air fryers, but of course also kitchen machines, kitchen assistants and food processors, that are driving volume growth within this segment.

Among food processors/kitchen appliances, we find a persistent trend where the shares are increasing for the really large kitchen appliances and the smaller food processors:

Vacuum cleaners – bagged and stick vacuum cleaners are gaining market share

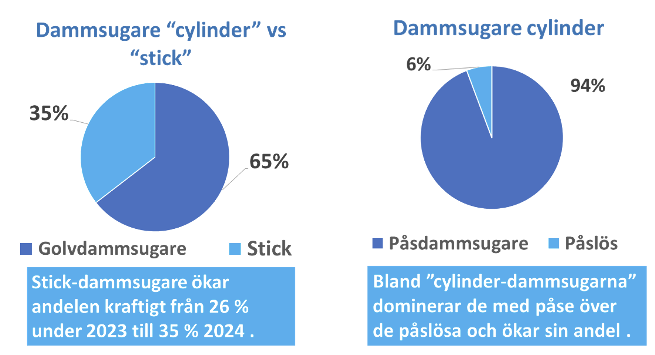

Vacuum cleaners are a product category that, with an "almost zero result" (-0.3%), maintains volumes towards 2023. There are also two clear main trends here in 2024:

On the one hand, hand-held stick vacuum cleaners (so-called ”stick”) are gaining ground in Swedish homes. They are often used as a complement to the traditional vacuum cleaner, but in many households as the only vacuum cleaner (with the high suction capacity that the new variants have). The other clear trend within this product category is the total dominance that bagged floor vacuum cleaners continue to have. These bagless variants are having a tough time on the Swedish market.

How to summarize the household appliance year 2024?

As a brief summary of the white goods year 2024, it is probably easiest to pick these words from the dictionary:

- A gap year with a tendency towards turnaround

- Increased new housing production would have a positive impact

- A heavy consumption situation for non-durable goods

- Increased costs for the consumer due to a sharply increased electronics tax

- Visible trends towards energy-efficient technologies such as induction and heat pump tumble dryers

APPSTAT, which compiles and delivers all market data from APPLiA's member companies, thanks all data providers across the member companies for 2024 and looks forward to continued good cooperation in the coming year.