2023.02.22

Retail Day 2023 and E-barometer 2022 annual report

How you should invest to get out of the storm, not just as a survivor, but as a long-term winner, was the theme of Retail Day 2023, which aired on February 21 and where the E-barometern annual report 2022 was presented.

In a perfect storm, retail faces an uncertain future, where yesterday's premises can be overturned overnight. The economic situation is pressuring retail companies to both cut costs and find new revenue streams. To survive and win the battle for consumers in an extraordinary time characterized by complexity and uncertainty, we need to challenge old truths and find new solutions, Retail Day 2023 revealed.

Moderator Ellinor Persson spoke with Jan Jakobsson, Head of Business Support Digital & Partners, and Carin Blom, External Strategist, at PostNord about the E-barometer 2022 Annual Report and it emerged that only two product categories had positive growth in e-commerce in 2022 – pharmacy goods which grew by 10 percent and clothing and shoes which had growth of 2 percent.

Jan Jakobsson said that the pandemic years meant that e-commerce took enormous strides, in 2022 it is higher than if there had been no pandemic - e-commerce turnover last year was therefore higher than in 2019 (even higher than in 2020) but fell 7 percent compared to 2021.

The reason why last year's biggest winner - the pharmacy trade - succeeded well, said Jan Jakobsson, is a wide range combined with speed - in 2019, one in ten purchases in the pharmacy trade was online, while the figure has now doubled to one in five purchases.

– We know that consumers are placing higher and higher demands on both purchases and delivery, and they are demanding better product information and images as well as a better search function, says Jan Jakobsson, and explains that most have realized that check-out is also very important, with 71 percent receiving their latest favorite delivery method with their latest e-commerce purchase.

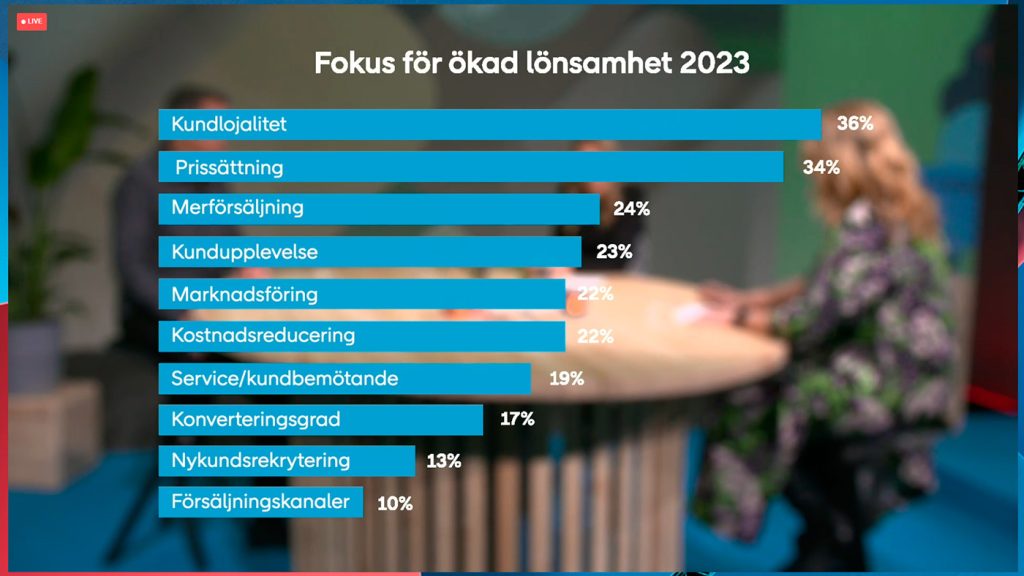

Carin Blom said that for e-retailers there is a different focus on profitability and not just growth now, and that sustainability is an important part of the report, where you can take part in three possible scenarios for the future, which are based on analyses from HUI and PostNord.

The most positive scenario is called "the wind turns" and means that e-commerce increases this year and makes up for the loss from last year - not due to increased demand, but rather inflation/price increases that cause sales to increase.

The intermediate scenario is called the ”pause year” and involves zero development this year.

The bleakest scenario is called "a deeper crisis" and means that consumers will sharply cut back on capital goods, the reduction this year will be as large as last year, and only in 2025 will we be at the figures from 2021 again.

During Retail Day, viewers were asked to vote on which scenario they believed in, and 69.2 percent voted for the "break year", 20.3 percent for "a deeper crisis" and 10.5 percent for "the wind turns".

Academic perspective

Sara Rosengren, professor of retail at the Stockholm School of Economics, spoke, among other things, about the fact that household finances are more strained now and that of course affects how people spend their money - during a recession, people hold back on what is not necessary.

Sara Rosengren also addressed the two concepts of time and ownership. In terms of time, it was mentioned that players in China have started offering alternatives where you have to wait 10–14 days for goods to get a lower price, and in terms of ownership, music was mentioned as a clear example of an area where we have largely shifted to access instead of ownership.

In the academic block, Katarina Graffman, PhD in cultural anthropology, also spoke about the paradox of freedom of choice, where she talked about herd behavior, among other things, and explained that checking what sells the most in online stores is a good way to investigate it.

Katarina Graffman said that it is important to look outward, so that you don't get stuck in your own business, and explained that it is the customers who fill a brand with resonance, and customers are influenced more by their group than by marketing communication.

– As early as 2008, young people said that they don't want sustainability printed on their faces in marketing, because they take sustainability for granted, says Katarina Graffman.

Two approaches

Nicholas Bàlint, Head of Live Commerce at Kjell & Company, talked about the company's initiative "Shop live with Kjell", where store staff unpack products, provide information about them, and more, which was started during the pandemic and was successful.

The idea was to meet customers digitally in the same way as in stores, and to differentiate yourself from others so that you become a player of choice, explained Nicholas Bàlint, and said that to get people to watch live you need something unique, such as discount codes or even better, competitions. As an example of live competitions being the thing, Nicholas Bàlint said that they received more than 4,000 Christmas rhymes in a competition.

– Most of the elements are profitable, but not all, but all are important for brand building, says Nicholas Bàlint.

Lina Hasic, Kronans Apotek, said that they are investing in Metaverse, and that they are the first in their segment in Sweden (maybe the first in the world). They have built a ”Pharmaverse” of almost 700 square meters and a ”Dare to Ask Room” where you meet an avatar and the idea is to de-dramatize the sensitive questions about, for example, foot sweat and the like. Step one in this investment, however, is a quit smoking training for the employees, and it will work on a regular monitor and mobile, but the experience will obviously be better with VR glasses.

A "Dare to Ask Room" might be something for Kjell & Company too, so that customers dare to ask stupid technical questions.

The future and pricing

We are moving towards an e-commerce climate with fewer but larger players dominating, was one of the conclusions drawn during the day, and the most important question for e-retailers was: Why do you exist?

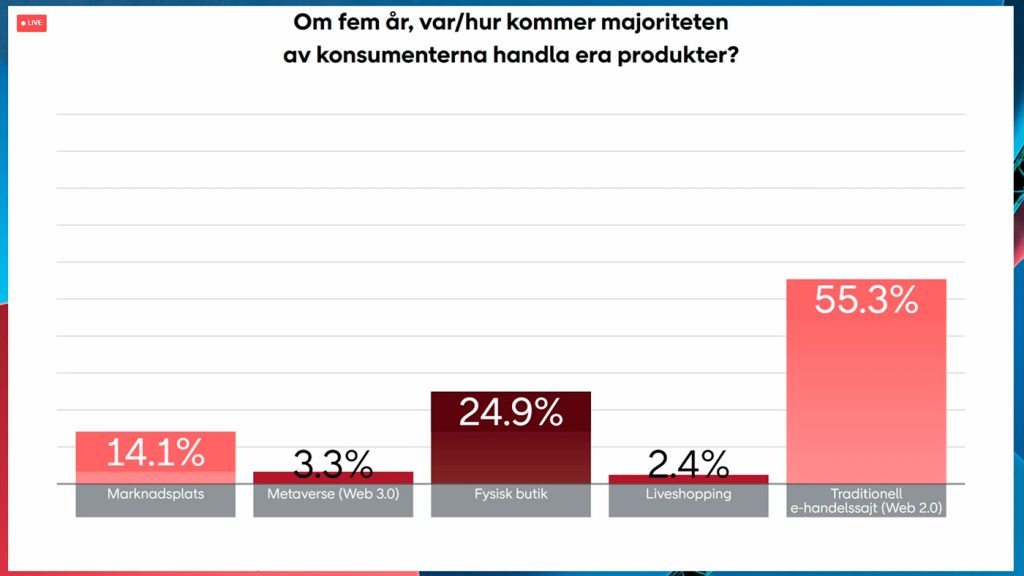

When asked ”In five years, where/how will the majority of consumers buy your products?” the answers were as follows:

55 percent – Traditional e-commerce site

25 percent – Physical store

14 percent – Marketplace

3 percent – Metaverse

2 percent – Live shopping

One topic for the day was ”Why is pricing so important?” and with example figures from Boozt.com 2022, Kristoffer Cedfors, Director of Commercial Strategy at investment company Verdane Capitals, explained the following:

A 5 percent improvement in sales volume means that operating profit increases by 45 percent.

A 5 percent reduction in purchasing costs means that operating profit increases by 81 percent.

A 5 percent reduction in other costs means that operating profit increases by 48 percent.

A 5 percent increase in prices means that operating profit increases by 122 percent.

Kristoffer Cedfors also said that one difference compared to before is that it is now super fast to check out and go to another e-retailer to shop more, and since shipping is often free today, you can easily shop from several places and not like before – when you usually made an e-commerce purchase in one place.

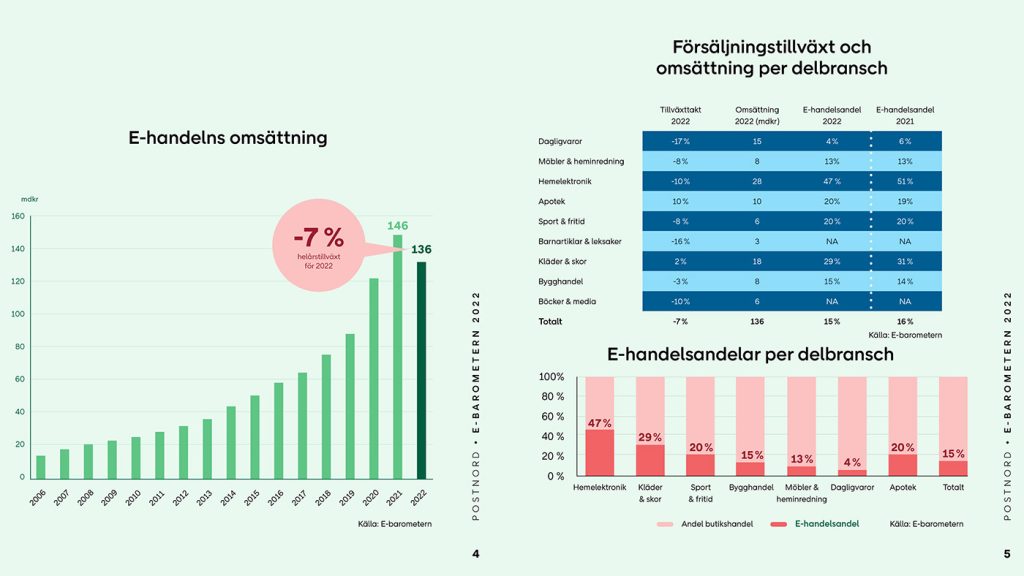

E-commerce declines for the first time in 16 years

PostNord's E-barometer shows a negative development in e-commerce for the full year for the first time since 2006. Total turnover, SEK 136 billion in 2022, is a decrease of seven percent compared to the previous year.

Grocery e-commerce declined the most of all industries in 2022, declining by 17 percent. The Consumer Electronics segment (which includes white goods and household appliances) declined by 10 percent, and is still the segment with the highest e-commerce share, although in 2022 it did not constitute more than half of what it did in 2021 (51 percent), but 47 percent.

Online clothing and footwear sales (where the e-commerce share is the second largest at 29 percent) had a growth rate of 2 percent and, together with pharmacy sales, which increased by 10 percent, are the only industries that did not report negative growth.

The fashion industry has been investing in a circular business for some time with used clothes and recycled goods at lower prices. The consumer electronics trade, which was hit hard in 2022, is now trying to do the same. New companies specializing in used goods and repaired goods in consumer electronics are growing.

“The challenges the industry is currently experiencing also present opportunities. New players with new business ideas and old players with new solutions will likely lead to an interesting development of e-commerce,” says Mathias Krümmel.

The three-hour broadcast of Retail Day 2023 is available on www.postnord.se/retailday

The 61-page E-barometer 2022 annual report (published by PostNord in collaboration with HUI Research) can be downloaded at www.postnord.se/e-barometern

Text: Ola Larsson

Images: Screenshots from Retail Day 2023 / images from the E-barometer 2022 annual report