2023.04.18

Rare goods sales decreased in February

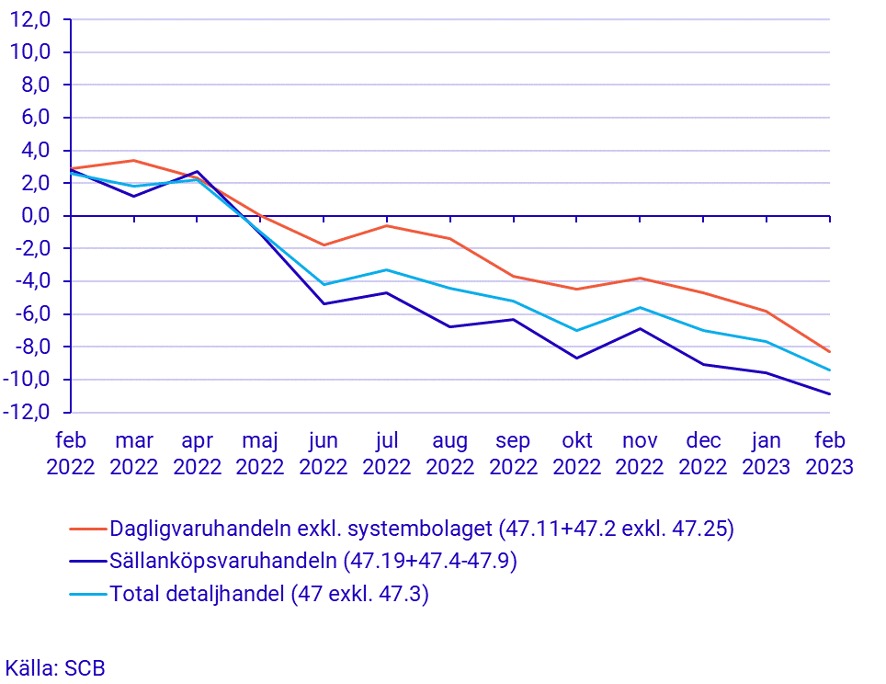

For the entire retail sector in Sweden, sales volume in February decreased by 9.4 percent compared to the corresponding month in 2022 in both unadjusted and calendar-adjusted figures, Statistics Sweden announced last week. The retail trade in non-durable goods (which includes white goods) decreased by 10.9 percent and the grocery trade, excluding Systembolaget, decreased by 8.3 percent compared to February 2022.

Inflation gives trade a slightly less bad development when retail turnover is measured in current prices by Statistics Sweden. Then, total retail turnover increased by 3.1 percent in February 2023 compared to February 2022. Retail trade decreased by 2.2 percent while grocery trade, excluding Systembolaget, increased by 10.7 percent. Price increases in food contribute strongly to this.

Back to the situation before the pandemic

The decline that has been ongoing since the sales peak in 2021 has brought the overall retail trade back to a similar situation to before the pandemic (see above). SCB also points out that in the current situation, with sharp price increases, consumers may change their purchasing behavior and buy slightly cheaper products instead of those that have increased in price.

February – tough sell-in data for the industry

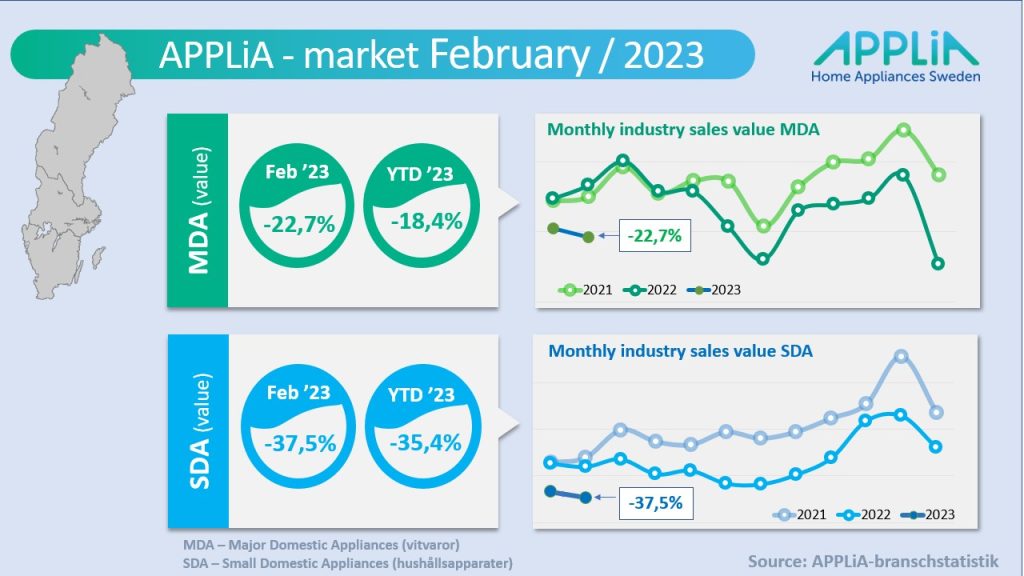

Applia's market statistics show that the industry's white goods and household appliances had a tough sales month in February. Compared to February 2022, the month this year is down by just over 26 percent for the entire industry, which for the first two months gives an accumulated outcome of 22.4 percent for the entire industry.

Sales to the trade are negatively affected by the large inventories that retail players currently have as a result of reduced consumer demand.

Now, we also have to compare with a strong result in March last year, where the positive pandemic effect was still visible in the statistics. After March 2022, the market began to weaken – the Ukraine war affected inflation, interest rates and consumer sentiment – which means that we expect the comparison with the previous year to be somewhat less negative as we enter the second and third quarters of this year.

February – tough comparison with previous year

The industry's two main segments, MDA (major appliances) and SDA (household appliances), fell sharply in February compared to the same month last year. MDA was down 22.7 percent and SDA a whopping 37.5 percent compared to February 2022.

For MDA, the positive pandemic effect lasted until June last year (see graphs above). Therefore, we will probably have to get used to fairly large negative numbers until the third quarter of this year when we compare this year's development with the previous year. When we look at SDA, the market started to decline somewhat earlier than for its sibling MDA in 2022. Here we saw the first signals that the positive pandemic effect had already been broken at the end of the first quarter of last year.

There are a few product categories among white goods and household appliances that show an increase compared to last year; for example, built-in refrigerators and freezers are doing well with continued deliveries to the completion of condominiums and single-family homes. Within SDA, it is the 'ironing equipment' category that is recovering from several years of decline.

//Kent Oderud