2023.09.20

Holiday pace in the market

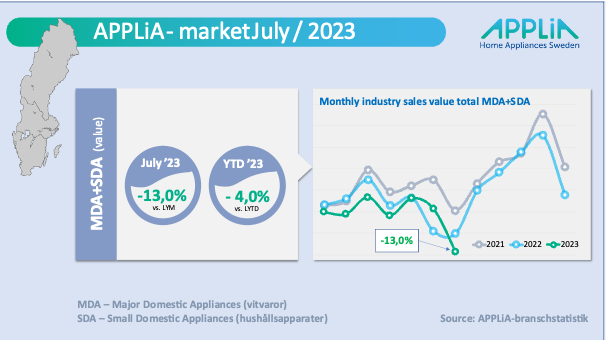

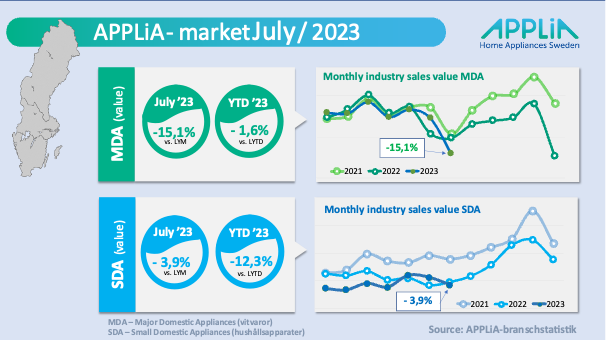

Deliveries of industry goods to retailers and users during the holiday month of July were clearly lower than in the previous two years (see graph). We have to go back to before 2019 to find an equally weak month in terms of value. If we also take into account the development in fixed prices (= volume), we have to go even further back in time to find similar results for the month of July. It is the larger white goods (MDA) that are most affected. Dishwashers are the only product segment that stands out and is closest to reaching the level of last year. For the other product segments within MDA, the results in July look consistently negative.

Some bright spots among household appliances (SDA)

The industry's household appliances (SDA) managed to keep the holiday decline in July at bay, and they are losing just under four percent compared to the same month in 2022. The vacuum cleaner and iron/ironing equipment segments in particular had a better value outcome than July 2022, which lifted the figures slightly. Accumulated over the first seven months of the year, the SDA result improved slightly and is now at a 12.3 percent decline compared to 2022. Now that autumn and Christmas are approaching, which is normally favorable for the industry, we will see if it is possible to match last year's figures for the smaller household appliances.

Exciting state budget

Applia has not yet had time to review the autumn budget in its entirety, which was only presented today. But the parts we have been able to see in advance have concerned reduced taxes on snus, the abolition of the single-use bag tax, increased defense appropriations and a raised ceiling for tax deductions and other measures to strengthen the construction and housing sectors.

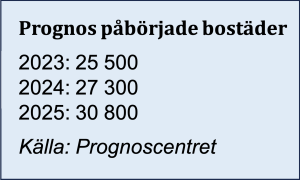

The construction industry will need stimulus as there is a near-panic slowdown in housing production in the country. The Forecast Center expects that we will fall all the way down to below 26,000 new housing starts this year – a new low point.

The forecast center does not believe in a rapid recovery, but expresses hope that we have reached the bottom in 2023 and that the government's medicine will have some effect by 2025.

Retail in general

It appears that household consumption may be partially mitigating the downturn in the Swedish economy. Statistics Sweden reported this week that Swedish retail sales volume increased in July. Turnover for the entire retail trade measured in current prices increased by 6.8 percent in July 2023 compared to July 2022. Non-durable goods trade increased by 6.0 percent and grocery trade increased by 8.7 percent.

But it is the price increases that are inflating the figures. Without the impact of inflation with the reporting of so-called fixed prices in retail, the trade in durable goods decreased by 1.9 percent and the trade in grocery goods decreased by 2.5 percent – all according to Statistics Sweden.

Text: Kent Oderud