2023.03.22

Tough start to the year for the industry

The industry is declining compared to 2022

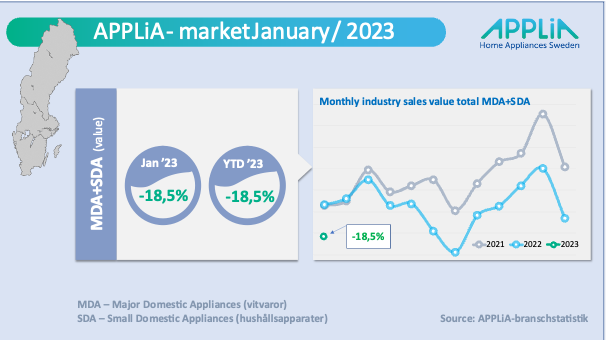

The year 2023 has started weakly, as the industry's purchasing statistics for January clearly show. Compared to the record years during the pandemic, the total industry value for the industry's large appliances and smaller household appliances is just over 18 percent lower, see the chart above. Even compared to 2019, this year's January does not reach the level that market sales reached then.

Our industry follows the pattern we see in the entire consumer durables trade in Sweden. Compared to the corresponding month in 2022, the entire retail sales volume in January decreased by 7.5 percent in so-called calendar-adjusted figures, Statistics Sweden announces in its most recent statistics. As a result, consumer durables trade, which also includes our industry products, decreased by 9.9 percent and grocery trade by 5.0 percent.

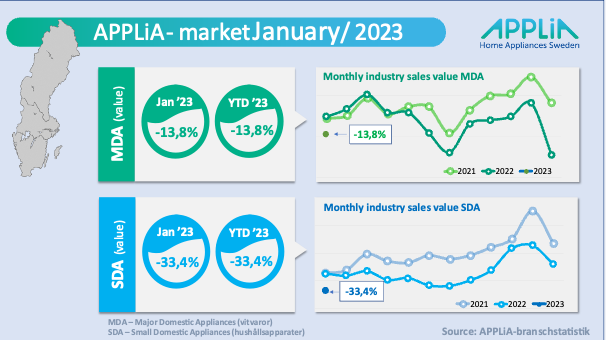

Large appliances have a few plus points

For major appliances (MDA), the decline in January this year compared to the same month last year is 13.8 percent. This decline is evenly distributed across the different product segments within MDA – only a few product categories show positive value figures compared to last year's January: built-in refrigerators and freezers and built-in hobs.

Heavy for small household appliances

Household appliances (SDA) are lagging significantly compared to the same month last year, down a whopping 33.4 percent. A significant decrease in customer demand and continued heavy inventories in the retail sector are the reasons for this sharp deviation.

Next year it will turn

With only one month of the new year behind us, it is difficult to say anything in more detail about how the industry will develop during the rest of the year. However, with the signals from HUI's forecasts of developments in Swedish retail, we see that theEconomic activity in the country will generally decline in 2023. However, the decline is forecast to be relatively short-lived and positive growth figures are expected again next year, albeit relatively low compared to historical growth rates. The forecasts for both GDP and household consumption are revised down to -1.6 percent and -2.5 percent respectively for 2023.

The rare goods trade continues to have a tough time

The forecast for retail trade in 2023 is revised up to 2.0 percent measured in current prices and the development in 2024 is forecasted at 1.0 percent. Growth is also expected to continue to be driven by price increases in the grocery trade. The forecast for the non-durable goods trade, however, is negative in both constant and current prices. All according to the experts at HUI Research.

Text: Kent Oderud