2024.03.22

White goods decline – household appliances gain

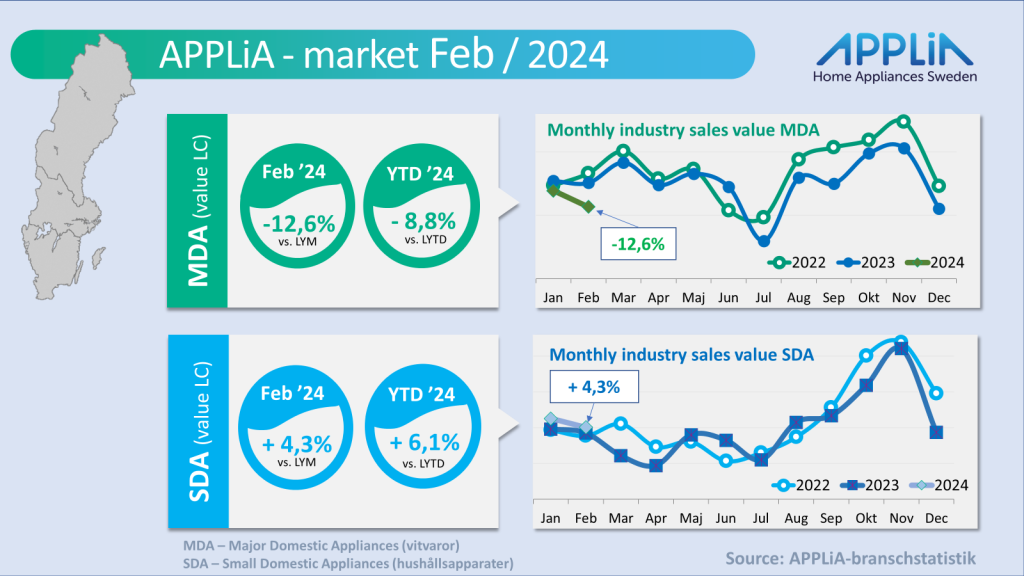

In the shadow of declining housing production in Sweden and the unfavorable situation for major renovations, sales of white goods (MDA) continue to decline in the beginning of 2024. For smaller household appliances (SDA), the journey towards recovery begins with big steps.

A large part of the weak GDP growth in Sweden over the past year is due to a sharp decline in housing investments, which have lost 26 percent since the fourth quarter of 2022. This is now leaving its mark on industry companies' deliveries of major white goods (MDA) to housing projects. During the first two months of the year, the sell-in value for these has fallen by 8.8 percent compared to the same period last year.

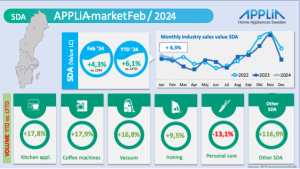

For small household appliances (SDA), the situation looks more positive. For these, both volume and value increased during January/February. If we take a closer look at what is behind the 6.1 percent increase in value, which the first two months of the year show, we can see that most product categories within SDA are increasing significantly.

SDA categories on the rise

Coffee machines show a very good volume development, up 17.9 percent, and this is supported by increasing volumes for both capsule and filter brewers. For the kitchen appliances category, many product categories also have a positive development. Most notable are food processors, hand blenders, toasters and air fryers, which all show strong volume increases compared to the previous year.

Among vacuum cleaners, stick vacuum cleaners and bagged floor vacuum cleaners account for the largest volume increases.

The high increase in other household appliances is primarily due to increasing sales of air purifiers and humidifiers.

Depressing for consumer durables

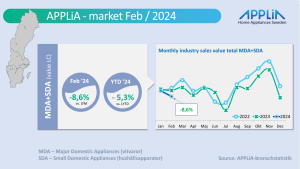

For the entire industry as a whole, the APPLiA figures now show a decline of 5.3 percent during the first two months of the year. Compared to the outcome in Statistics Sweden's latest retail report, the industry is slightly below the development in the non-durable goods trade in Sweden.  Statistics Sweden's report shows that the sales volume of non-durable goods retail decreased by 1.8 percent compared to the corresponding month in 2023. The APPLiA market is of course affected by this development in retail, but also to a large extent by the reduced housing investments, which were mentioned at the beginning of this post.

Statistics Sweden's report shows that the sales volume of non-durable goods retail decreased by 1.8 percent compared to the corresponding month in 2023. The APPLiA market is of course affected by this development in retail, but also to a large extent by the reduced housing investments, which were mentioned at the beginning of this post.

In a month or so, it will be time to sum up the first quarter. Lots of positive signals for the Swedish macroeconomics are whizzing around in the air like wild spring pollen – lower inflation, expected interest rate cuts, a stronger currency. In other words, maybe things will brighten up soon.

Text: Kent Oderud, APPLiA Sweden