News

APPLiA's consultation response on economic instruments for a more circular economy

On March 11, APPLiA submitted a response to the report by SOU 2024:67 ”On economic instruments for a more circular economy”. APPLiA believes that the investigation has an outdated view of waste and emphasizes that products are now seen as a resource. APPLiA is critical of the chemicals tax and believes that it distorts competition, is administratively burdensome and lacks […]

Now it's confirmed - the electronics tax makes things even more expensive

The Swedish Tax Agency has now added up the billions declared for electronics tax to the authority in Sweden during the full year 2024. The large increase in the tax levy that was implemented on July 1, 2023 is now showing its full impact on the full-year figures for 2024. APPLiA's chairman Kent Oderud comments on the year with the Electronics Tax. Despite a decline in sales of, among other things, white goods […]

The industry is unanimous – abolish the electronics tax

APPLiA and eight other industry organizations are jointly urging the government to abolish the electronics tax. The tax, which was originally introduced to protect the environment, has instead led to negative consequences such as higher prices, increased trade in dangerous products by unscrupulous actors and a weakened Swedish competitiveness. APPLiA, Electronics Industry TechSverige, Swedish Trade, Technology Companies, Confederation of Swedish Enterprise, Computer Games Industry, Small Businesses and the Industry Association for Catering Suppliers feel a […]

Increased electronics tax from January 1, 2025

The Swedish Tax Agency has announced the new tax rates for the electronics tax on white goods and home electronics from 1 January 2025. The index increase that takes place on this date follows the index from July to July and ended at plus 2.6 percent. The maximum tax amount of SEK 548.21/item arises for white goods with a net weight of 44.5 kg and above […]

The Chairman: Political workshop and action now

Already when the electronics tax, also known as the chemicals tax, was introduced in 2017, there was widespread questioning. The state's own authorities, the Swedish Tax Agency and the Swedish Customs Administration, advised against its introduction. Extensive investigations by the Swedish Chemicals Agency and others have shown the tax's ineffectiveness in trying to change the flame resistance of white goods and home electronics. The Swedish market has proven to be too small to control […]

The report is clear: Dramatic increase in tax collection

APPLiA is today releasing a comprehensive, follow-up report on the impact of the electronics tax last year and a forecast for how the tax will perform this year. The report shows the causes and consequences of the dramatic increase in tax collection that has occurred. Since the political change in the structure of the electronics tax (also called the chemicals tax), which would make it easier for authorities to […]

Strong voices on the electronics tax from the Riksdag

In a global market, the environment should be seen as a global issue, that is the message from MP Larry Söder, Christian Democrats. The Sweden Democrats, in turn, view the tax as a greenwashed fiscal tax introduced by the previous S/MP government. In their previous budget motions, the party therefore chose to abolish the electronics tax. Hear more about the Tidö parties' reasoning below. "We are on […]

The increase in the electronics tax for white goods is boosting inflation

The increased tax collection of the electronics tax is reflected in Statistics Sweden's latest inflation statistics for both private consumption and construction costs. Overall, the figures show that this Swedish special taxation on white goods and home electronics is curbing inflation. Inflation continued to fall in December 2023, from 5.8 percent in November to 4.4 percent in December, Statistics Sweden announced in January. The biggest reason for […]

Member of Parliament: The electronics tax should never have been introduced

”The electronics tax should never have been introduced and it should of course be removed as soon as possible.” This is what MP Sten Bergheden says in an interview with APPLiA. Listen to the full interview below.

2024 – A crucial year for the electronics tax

In the wake of growing criticism of the electronics tax, which has increased in scope and impact since 2017, 2024 is predicted to be a potentially decisive year for its possible survival. With increased political attention and a strong voice from the Moderate Party, the new year could mean a turning point for consumers and Swedish retailers in the fight against a tax that has been criticized for […]

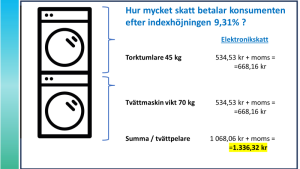

New tax rates – tax increases by 9.31 percent

So it's time again – after five months, the tax rates for declaring the electronics tax will be updated again at the turn of the year. This time, it's just over 9 percent index increase that affects the maximum tax amount per item from January 1, 2024. One new thing is that this time the Swedish Tax Agency will not round to the nearest kroner amount but will let the amount be expressed […]

The evidence is accumulating – the government deceived the Riksdag

On July 1st of this year, the deduction option was removed for the part of the electronics tax that concerned reactively added flame retardants. Reactively added flame retardants are considered the better environmental alternative for adding to electronics to protect against fire. The additively added agents, on the other hand, had no possibility of deduction. The change, which was presented by the Ministry of Finance as a simplification, would […]